Data deep dive: Do Gmail and Outlook users engage with core business apps differently?

Have you ever wondered which applications your colleagues use most frequently? Here at Productiv, we’re always interested in taking a peek behind the curtain. This time around, we wanted to understand how companies have set up their application ecosystem — and how that ecosystem impacts employee productivity.

We were particularly curious about whether the lines are clear-cut for Google Workspace and Microsoft 365 users. Also on our minds: Do Google and Microsoft users leverage other core business tools differently? We wanted to see how the “Google versus Microsoft” debate impacted the usage of tools for document creation, collaboration, and file sharing.

A quick note before we dive in: We measure app usage by analyzing what each user does beyond simply logging in to a tool. We classify engaged users as those who have been active inside an app (post-login) within the last 30 days.

Outlining the Core App Stack

The vast majority of Productiv customers manage hundreds of SaaS apps, with many that are specialized for specific departments and tasks. However, virtually all businesses have a set of foundational applications that every employee can access. Those apps fall into the following categories:

- Email (Outlook or Gmail)

- Messaging/Real-Time Collaboration (Slack or Teams)

- Video Collaboration (Zoom, Webex, Teams)

- File Sharing/Collaboration (Google Drive, Box, Dropbox, One Drive)

- Document Creation (Office 365 or Google Docs)

But how are employees using these core applications? In the context of the Google and Microsoft email platforms, we decided to take a deeper look at which tools had the highest engagement levels. For example, if you’re a Microsoft Outlook user, are you more likely to use Slack or Microsoft Teams?

Google vs Microsoft: What Does the Data Say?

First, we need to talk about the Google versus Microsoft debate. The industry perspective has been that you are either a Microsoft 365 or a Google Workspace customer — but our data shows the truth is more nuanced.

A significant majority of our customers have access to both. That’s not to say all products are deployed or used, but many customers have purchased licenses across both ecosystems.

However, the lines are quite clear on the email front. Anyone with experience deploying Microsoft 365 and/or Google Workspace will tell you that dual email platforms aren’t really possible with split MX records or email forwarding. As such, it makes sense that we see little to no overlap in email platform usage.

Two-Thirds of People Use Gmail

Our analysis found that two-thirds of Productiv users use Gmail as their primary email platform, while the remaining one-third use Microsoft Outlook. (For the purposes of this analysis, we did not differentiate between usage of web browsers and email clients.)

Don’t count Microsoft out just yet though — we see their footprint increasing in this space as Google lags with enterprise customers. Based on our conversations with numerous CIO communities, Microsoft appears to be more aggressive than Google on the pricing front.

It’s clear the debate is no longer one or the other. What started as a SaaS versus on-premise debate has become a nonissue, as both email platforms are now almost entirely SaaS (aside from that one on-premise server for Microsoft you almost certainly have but never talk about). And in terms of features and functionality, the two are on par with one another.

Do Businesses Really Stay Within the Microsoft or Google Ecosystem?

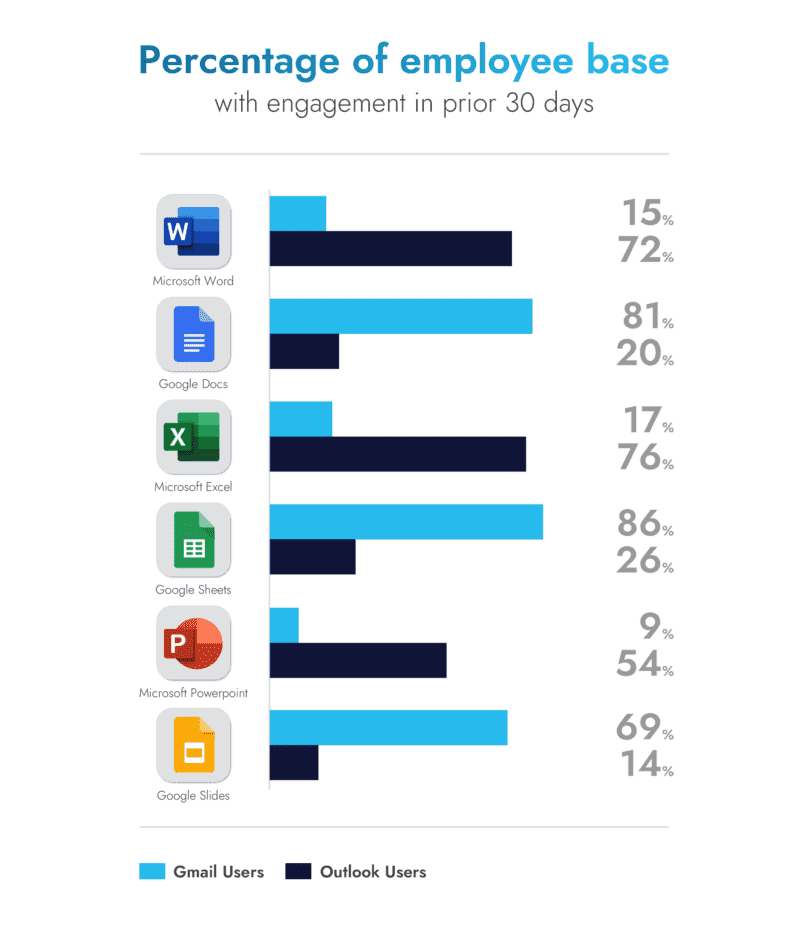

Now let’s move onto the question of whether Gmail and Outlook users tend to stay within their respective Google and Microsoft ecosystems. In theory, it seems sensible that you would use Google Docs if you’re a Gmail user and Microsoft Word if you use Outlook.

Our research shows otherwise.

For customers who use Gmail as their primary email platform, 83% have also deployed Microsoft Office. However, only around 10% of those people actually use Office apps (when you look at engagement data for those people over the prior 30 days).

Conversely, 30% of customers who use Outlook also use Google Workspace for documents (Google Docs). That group had a 22% engagement rate on Google Workspace for the prior 30 days.

In short, the Microsoft Office suite of products isn’t as dominant as it once was. Even Outlook users have lower engagement with the remainder of the Office suite compared to Gmail users who are using Google Docs, Sheets, and Slides:

We’re beginning to see a trend here that will continue as we analyze other core business tools: Gmail users tend to have higher engagement on all applications across the board — not just within their ecosystems or when there is overlap.

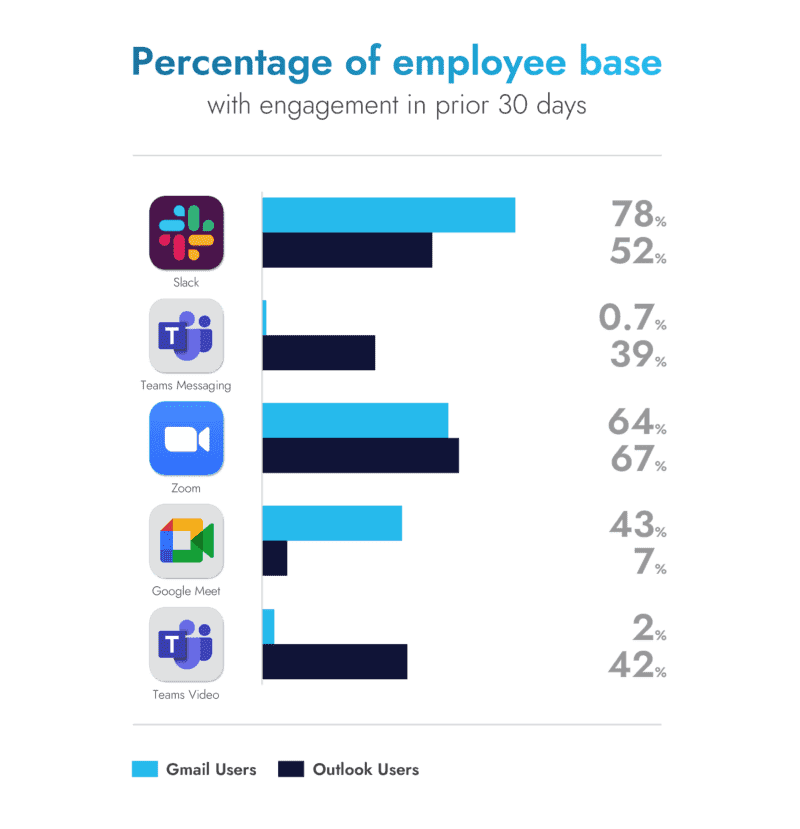

Slack and Zoom Top Collaboration Tool Usage

Now let’s take a look at how Outlook and Gmail users are engaging with the most popular collaboration apps:

- Slack

- Microsoft Teams Messaging

- Zoom

- Google Meet

- Microsoft Teams Video

Once again, we’ve used the Gmail and Outlook email platforms as the anchor to help compare usage.

What’s interesting to note is that Slack usage is significantly higher across the board, despite Microsoft’s marketing push to bundle Teams with other products and promote the tool as “free”.

While Microsoft may be winning the argument that it has more customers, they’ve neglected the first rule of deploying new tools and platforms: User engagement is key! Giving customers access to Teams doesn’t necessarily mean that users are actually engaged with the tool.

In fact, our data suggests the opposite is true — that users with access to Teams typically have access to other collaboration tools and are using those other applications at a significantly higher rate.

Microsoft also has a tendency to log individuals as engaged Team users even when they aren’t licensed for the tool, so our percentages may be even higher than actual usage.

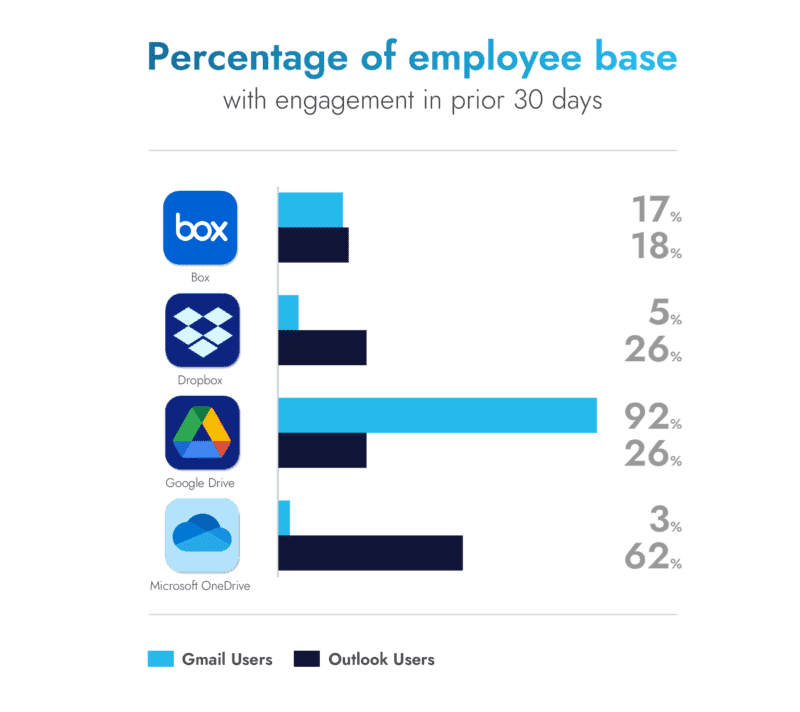

Google Drive and OneDrive Lead in File Storage

It’s critical that every business has a place to store all their relevant documents and materials that employees produce. So it made sense for us to also look at how Gmail and Outlook users leverage four of the top file storage tools:

- Box

- Dropbox

- Google Drive

- Microsoft OneDrive

According to our analysis, the majority of Google and Outlook users stick with the file storage tool in their ecosystem (Google Workspace or Microsoft 365). Google Drive has the highest percentage (92%) of engaged Gmail users, while Microsoft OneDrive has an engagement rate of 62% among Outlook users.

What’s most interesting here is the meteoric rise of Google Drive. Five years ago, you could argue Google Drive was barely a product compared to Dropbox. However, the fortunes are very much changing. Gmail users in particular seem to show a strong affinity for Google Drive compared to the three other storage tools we looked at.

In Conclusion

In the end, it appears that what ecosystem you’re in matters. While Microsoft is winning the battle on the number of customers, it is clearly not winning the battle of who is using their products and driving employee productivity. We’re interested to hear: what are your experiences and views on the Google and Microsoft ecosystems?

Methodology:

- We have assumed that the email platform is the main anchor to the set of application used, and therefore are presenting the data showing behavior or users with Gmail, Outlook, or both.

- Given a large overlap found in email platforms across companies (in other words, having both Gmail and Outlook), we have re-categorized the groups (Only Gmail, Only Outlook, or both) so that it only reflects material use of an email platform. The logic for this re-categorization was: for those companies that have both Gmail and Outlook, if [(# of Accounts for an email platform) / (# Accounts for Gmail + # Accounts for Outlook)] < 10%, then we did not consider that company as using both platforms.

- % Usage: 30-day engagement for a specific app / (proxy of total users estimated by adding Gmail + Outlook accounts based on 120-day engagement)

Other notes:

- Removed 5 customers (as email users are significantly lower than users of other platforms, signaling incomplete data).

- Some SSO Apps, but mostly Okta, have a 30-day usage > total email users – this can signal external users that are given access to some platforms via SSO.

- The 4 companies that fall under “Both” are actually stronger Gmail users (have Outlook Usage / Max Users on the range 10%-20%)

- One customer has <10% usage for both Slack and Microsoft Teams (Messaging), indicating that it must use a 3rd-party messaging platform –> for Teams vs. Slack analysis it has been labeled as “None”.

About Productiv:

Productiv is the IT operating system to manage your entire SaaS ecosystem. It centralizes visibility into your tech stack, so CIOs and IT leaders can confidently set strategy, optimize renewals, and empower employees.

Learn more today