SaaS Intelligence Benchmark Series: 4 Ways Covid Has Transformed SaaS Adoption

By Kristin Crosier and Jin Baik

Over the past two years, we all witnessed a dramatic change in how people work and how businesses operate. Covid arrived, shelter in place became the norm, and SaaS adoption spiked as employees transitioned to working remotely.

But being the data nerds we are at Productiv, we had to know more about how Covid has transformed SaaS adoption. Yes, SaaS sprawl increased as app portfolios grew. Yet our minds raced with unanswered questions:

- How did SaaS portfolio growth vary across industries?

- Did adoption of new SaaS apps slow or increase across years one and two of Covid?

- How did the number of SaaS applications change across different teams?

We set out to find the answers with help from our trusty SaaS Intelligence insights.

4 key takeaways on SaaS adoption during Covid

Looking for a quick summary of the SaaS trends we found? We’ve got you covered! And if you want to know more, keep reading below for in-depth analysis and details about our methodology.

Here are our top takeaways on SaaS adoption during Covid:

- SaaS adoption skyrocketed with remote work, up 62% in the first year of Covid

- The average SaaS portfolio grew by another 28% in the second year, from 2020–2021

- Tech and Retail verticals led the adoption of new SaaS apps, with 100%+ growth

- In-person industries such as Retail likely adopted an outsized share of SaaS to better serve customers digitally while protecting their employees

- SaaS portfolios grew 12% YoY across 10 key teams

- Most teams adopted a more significant number of new apps in the first year of Covid (2019–2020) compared to the second year of Covid (2020–2021)

- R&D and Security teams saw the highest growth in number of apps used, up 49% and 33%, respectively

- Operations and Sales teams experienced the least amount of change, with about 10% growth

1. SaaS adoption skyrocketed with remote work

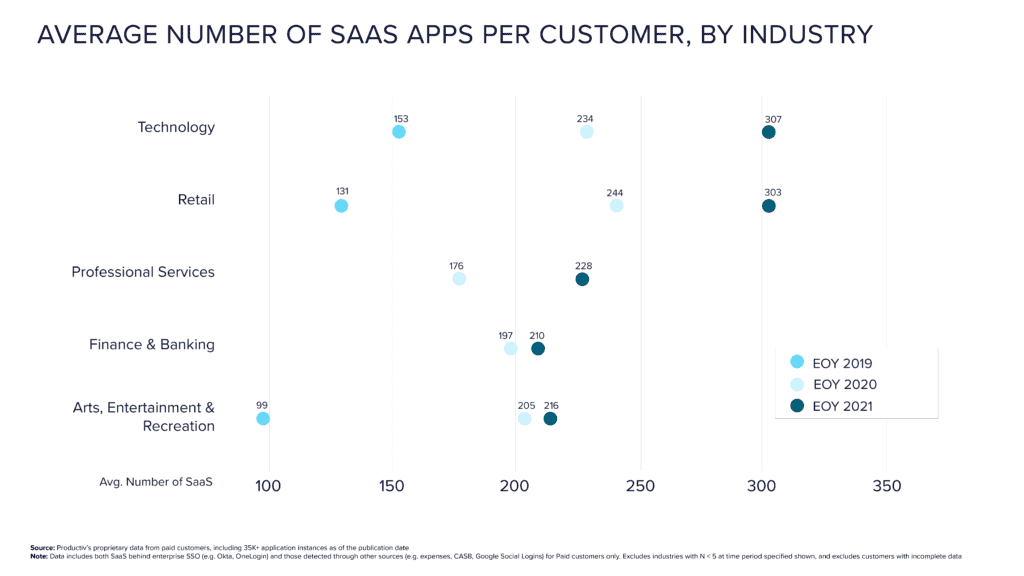

How have SaaS portfolios changed across verticals? Comparing data across 5 key industries, we saw the average SaaS portfolio grow by 62% during the first year of Covid (from 2019–2020). During year two of Covid (2020–2021), the average SaaS portfolio grew by an additional 28% across the industries we compared. Our analysis provides strong evidence that SaaS sprawl continues to be pervasive, regardless of industry.

If we step back to look at the compound average growth across those two years, that comes out to a rate of 44.2%.

Much of SaaS surge likely due to unmanaged apps

Interestingly, our data shows a more dramatic jump in SaaS adoption compared to Okta’s annual report from 2021. This finding suggests that a majority of the Covid-driven SaaS growth came from unmanaged and shadow apps (i.e. apps not behind enterprise SSO). Previous analysis we’ve done confirms that likelihood. In 2021 we discovered that on average 56% of a company’s SaaS are unmanaged apps not behind enterprise SSO.

A comparison of our data sets in this blog reaffirms the probable surge in unmanaged apps: SaaS growth was considerably lower among the 10 key teams we looked at below (+12% YoY on average) than our industry data (+62% during the first year of Covid). Based on our analysis, the majority of SaaS growth likely came from unmanaged apps used by non-key teams (i.e. those who may have been less reliant on SaaS in-office, but were heavy adopters during Covid).

2. Tech and Retail verticals led the adoption of new SaaS apps

As we expected, the most tech-forward companies led in SaaS portfolio size, with 307 apps on average in 2021. Tech businesses grew their SaaS portfolios by an average of 101% between 2019–2021.

Retail companies were close behind Tech, with 303 apps on average in 2021. Retail also saw the biggest jump in the number of SaaS apps across the entire time period we analyzed. The average Retail company’s portfolio grew by 131% from 2019 to 2021!

Why did such an extreme jump occur? On the Retail front, eCommerce grew 2x to 5x faster during Covid as consumers shifted their purchasing behaviors online. The pandemic likely prompted in-person industries to adopt more SaaS to better serve customers digitally while protecting their employees (you’ll notice the same trend applies to the Arts, Entertainment, and Recreation industry). Pre-pandemic, these industries may not have prioritized investing in SaaS (particularly if business operations were running fine as-is), but Covid catapulted the need for digital technologies.

3. SaaS portfolios grew 12% YoY across 10 key teams

Looking at apps via the industry lens was insightful, but our curiosity about micro trends across teams led us to another data set: how SaaS adoption compared across 10 key business teams.

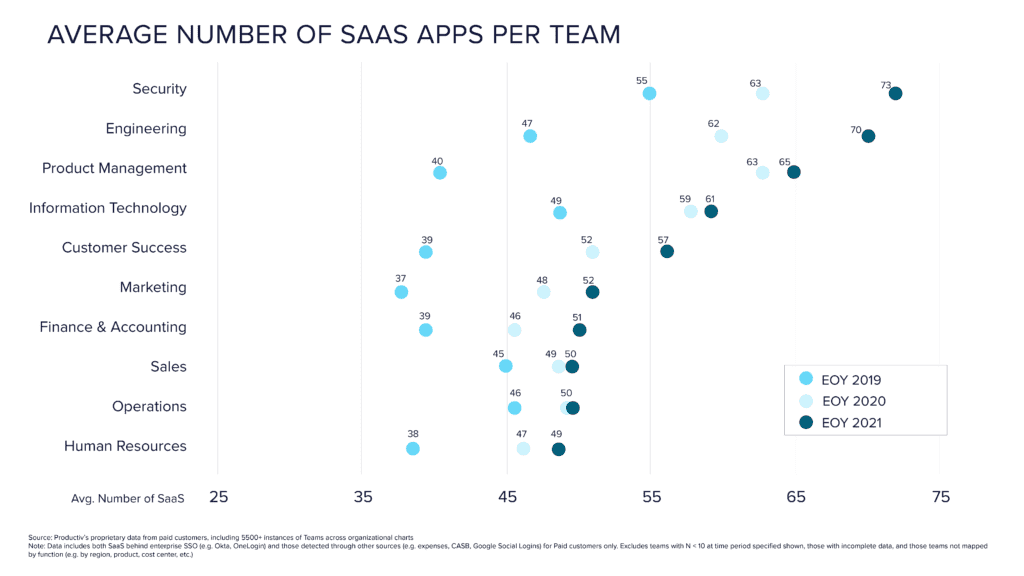

As expected, our analysis revealed significant growth in the number of SaaS apps per team from pre-Covid times (late 2019) through the second year of Covid (2021). Across 10 key departments, we saw an average increase of 12% year-over-year (YoY).

Comparing the first and second years of Covid, we saw higher growth in team SaaS usage during the period of 2019–2020 compared to 2020–2021. During the first year of Covid, companies were focused on equipping remote employees with the right tools to be productive — and unmanaged apps flourished. By year two, many teams likely already had a majority of the apps they needed.

4. Security and R&D teams saw the highest growth in number of apps used

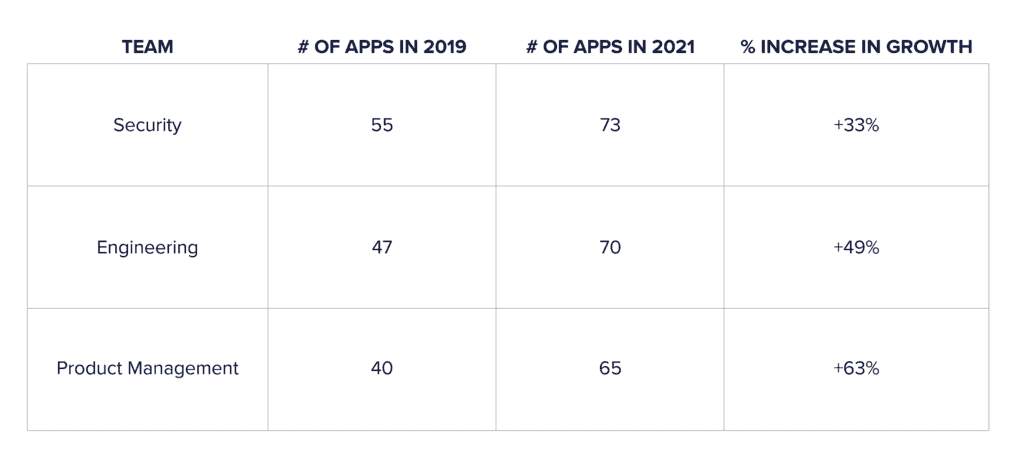

Per our analysis, Security and Engineering teams led with the highest average number of apps being used (with Product Management not far behind). Interestingly, Product Management teams saw the highest overall growth across the two years: the average number of apps used by PM teams increased by 63%!

How did Security and Engineering — the other teams with the largest shift in the total number of apps — compare? The number of Security apps grew by 33%, while Engineering teams saw a 49% increase.

As employees shifted to remote work, companies adopted more tools to protect two critical business functions: securing business data, and ensuring continued product innovation.

It’s worth noting that functions like Security often have a high number of lower-touch tools that run in the background. For data security and compliance purposes, Security teams also frequently require access to apps used by other teams. Both of those situations may contribute to the high number of apps found among Security teams.

Operations and Sales teams experienced >10% change

On the opposite side of the spectrum were Operations and Sales teams. These departments experienced the lowest average change in the number of apps used across both years of Covid:

The small increase in apps used between 2019 and 2021 suggests that Operations and Sales teams were already heavily reliant on SaaS for day-to-day operations. As a result, they required fewer new tools to help them transition to remote work.

Let’s talk about our data and how we analyzed it

Our data set is unique in that we capture all SaaS applications within a company’s portfolio, beyond SSO-enabled and IT-managed apps (whereas data sets from SSO providers are by definition significantly narrower). To get a complete picture, we also track unmanaged apps by aggregating data from HR systems, finance and expense management software, contract management tools and files, and SSO and CASB providers.

For this analysis, we looked at an anonymized subset of data from companies that use Productiv. We analyzed data spanning thousands of teams and 35,000+ apps across late 2019 (pre-Covid), late 2020 (Covid year one), and late 2021 (Covid year two). Our analysis of SaaS adoption is based on the data our customers make available to Productiv.

How intelligent insights can help drive SaaS adoption and increase ROI

With the right data, you can do so much more beyond tracking the size of your company SaaS portfolio (which is already difficult to do if you manually search for unmanaged apps).

You can analyze trends on the apps used by teams, which will help you see where spend is going and provide a starting point for de-duplicating apps or sunsetting low-usage tools. You can also benchmark against your peers to see how your portfolio size, spend, and usage compares.

The analysis above is just a sample of the many fascinating insights Productiv and our customers are able to glean using our SaaS Intelligence Platform. With SaaS Intelligence, you get a clearer picture of where to focus your efforts on driving adoption and how to increase the ROI of your portfolio. That’s why SaaS Intelligence is the future of SaaS management!

This blog post is part of our SaaS Intelligence Benchmark Series. Interested in more content from this series? Check out our deep dive into usage of Slack vs. Microsoft Teams.

About Productiv:

Productiv is the IT operating system to manage your entire SaaS ecosystem. It centralizes visibility into your tech stack, so CIOs and IT leaders can confidently set strategy, optimize renewals, and empower employees.

Learn more today