Mass layoffs in tech influencing CIO priorities in 2024

Simply put: 2022 was a tough year for the technology sector, and those concerns have carried into 2024. An uncertain economy, rising interest rates, and growing inflation put tremendous pressure on businesses that had spent the previous few years hiring employees and purchasing software to support rapid growth plans that were suddenly slowing.

2022 ended with a wave of tech layoffs that has continued on into the new year. In addition to 2022’s tech layoffs, over 135,000 employees have already been laid off across almost 500 tech companies in 2023. How are organizations adapting to this new reality and transitioning grow-at-any-cost mantras into efficient-growth mindsets?

Over the last few months, I sat down with over a dozen CIOs from our customer community to discuss how the current macroeconomic conditions and layoffs across the industry are impacting their priorities. From those conversations, three themes became clear.

1. Driving stronger alignment across GTM leadership, IT, and Revenue Operations teams

CFOs are keenly focused on profitability. With that, GTM teams are now required to be more declarative on which market segments they’ll be focused on. And in order to support this focus, GTM teams must partner closely with IT to build the associated processes and technology.

What caused the change

Leading up to 2022, growth was the number one priority. Companies were making higher risk investments by concurrently pursuing multiple segments, verticals, geographies, etc. Not all of these bets were paying off, and a slowing economy quickly magnified losses. As a result, companies have started scaling back these higher risk investments and are being more disciplined on where to double down and what to cut.

What this means going forward

GTM leadership, IT leadership, and Revenue Operations must strengthen their alignment to create a unified focus across new GTM strategies and initiatives. The following are some ways I’ve seen this playing out across our customers.

With tighter budgets and resources, GTM teams are doubling down on data and insights to make the best decisions on what to prioritize. For example, one company I spoke with is focusing on the Enterprise segment and investing in training and tooling their outbound Sales Development teams so they can effectively target prospects. This involves equipping Sales Development teams with a consolidated set of tools that deliver the data they need where they need it. In tandem, they’re reevaluating sales compensation plans to align company strategy more tightly with how frontline teams are compensated, which requires further system changes.

Another company is refocusing efforts on streamlining the flow of leads from marketing to sales to ensure tighter linkage across marketing leads and closed business. This translates into new processes for defining “lead quality,” “lead routing,” and “marketing attribution,” and requires IT investments across multiple systems.

For many companies, IT budgets for Marketing and Sales are flat or reduced, making now the time to re-evaluate the tech stack needed to support GTM strategies. Being able to measure if a tech investment is yielding the expected ROI is critical. And if the returns aren’t where they need to be, have plans in place to remedy the situation, potentially by eliminating or replacing the application. One company I spoke with decided to eliminate a purpose-built VoIP solution for sales and replace it with Zoom Phones at a small fraction of the cost.

2. Optimizing software costs through portfolio rationalization and spend management

Reducing headcount is a last resort and something that organizations work to avoid whenever possible. Saving jobs by cutting technology costs in a way that doesn’t impact business productivity or performance is clearly a preferred solution. However, many businesses lack the tools and insights needed to do so at scale.

Enterprises must review their SaaS portfolios to truly understand which software applications are critical for their operations, then take action by deliberately rightsizing, renewing, and retiring applications.

What caused the change

Leading into 2022, technology companies were on a major hiring spree. And when you hire people, you hire behaviors. With the decentralization of IT purchasing, it became the norm that a new employee was able to procure an application of their choice when they joined a new company.

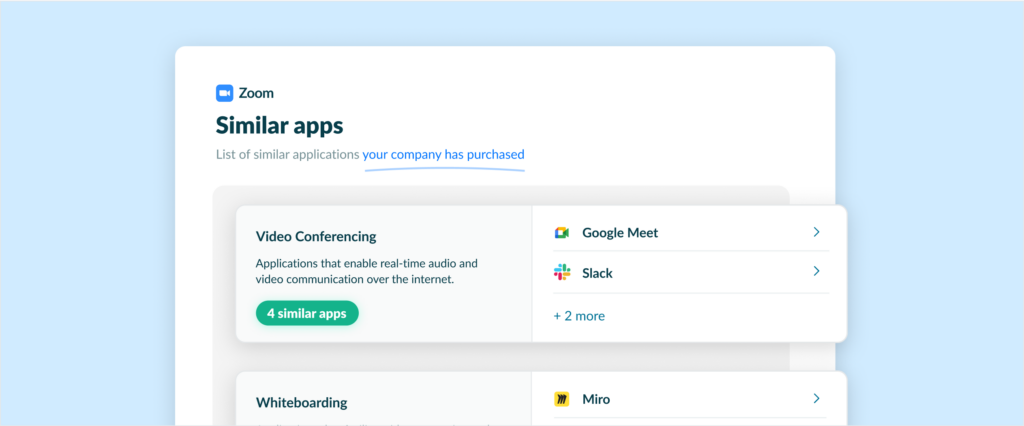

As a result, it’s not uncommon for a 3000-employee company to have 800+ unique applications. While this created greater employee autonomy in software choices, it also led to both information fragmentation (i.e., overlapping project management or whiteboarding applications) and wasted spend ($12,000+ annual software spend per employee).

What this means going forward

Many organizations now have a CFO- or CIO-led initiative to drive alignment across IT, Finance, Procurement, and Operational teams in order to create a shared vision on how to rationalize software application portfolios.

This is how some of our customers are working through this initiative:

- Build a foundational data-set for all applications being used across the organization.

- Align on assessment criteria (i.e. overinvestment in an application category; having 3+ Project management applications) to identify rationalization opportunities,

- Develop a POV on specific applications to reduce or eliminate. This leads to a shared vision for ideal software stack (independent of software renewal timing).

- Invest in resources to ensure migration paths for applications being eliminated and associated employee enablement.

- Systematically record cost savings or cost rationalization achieved.

3. Establishing an effective hybrid work environment

Most technology companies have rolled out Return to Office policies — there is broad alignment that in-office work is critical for collaboration and culture, however company policies vary from mandatory one- to four-day in-office policies. With this backdrop, CIOs are partnering with the C-Suite to align on expectations for in-office and remote work.

What caused the change

With the pandemic, most employees in the tech industry were required to work from home for an extended period of time. In the process, employees figured out how to work effectively and efficiently without being in the office. However, many studies indicate this negatively impacted employee mental health, work-life balance, and cross-team collaboration over time.

What this means going forward

As we enter the new year, most companies have formulated an “in-office work” policy for employees within driving distance to work in the office at least a couple days a week.

CIOs are partnering with the C-Suite and workplace teams to ensure in-office days foster collaboration and team building where employees consistently come into the office. But there are many questions to be answered.

If the entire workforce is in office the same day of week, do we have enough conference room space? If we are a two-day in-office company, should we reconfigure the office whereby we move to hoteling system versus assigned seating? Should we schedule weekly company lunches, happy hours, etc. to foster team connectedness during these days?

There needs to be a continued investment in technologies and processes to drive better collaboration across hybrid and fully remote employees. Enterprises were experimenting with many new tools and technologies for remote work during the pandemic. Now, CIOs are working to standardize employee experience across hybrid and remote work to build as much work environment parity as possible.

How Productiv helps

At Productiv, we partner closely with many of our customer CIOs and their leadership teams to drive software governance and strategic portfolio assessment initiatives. And we do so by leveraging the unique insights delivered by SaaS Intelligence™, portfolio and price benchmarks, and best practices we’ve developed across years of experience helping our customers transform their SaaS portfolios.

More than a SaaS Management solution, Productiv aligns IT, procurement, finance, and business leaders with trusted data to optimize spend and drive operational excellence across SaaS portfolios. This employee-centric, data-driven approach combines billions of employee app usage data-points with vendor contract and organizational data, enabling teams to easily come together to govern and rationalize SaaS portfolios while streamlining procurement.

Learn more about how the Productiv SaaS Intelligence™ platform works or schedule a personalized demo to dive deeper.

About Productiv:

Productiv is the IT operating system to manage your entire SaaS ecosystem. It centralizes visibility into your tech stack, so CIOs and IT leaders can confidently set strategy, optimize renewals, and empower employees.

Learn more today