2023 SaaS Trends – Spend

SaaS spend per employee now averages $9,643, and one-year contracts have increased as a percentage of all contracts from 79% in 2020 to 85% in 2022.

SaaS Spend Trends

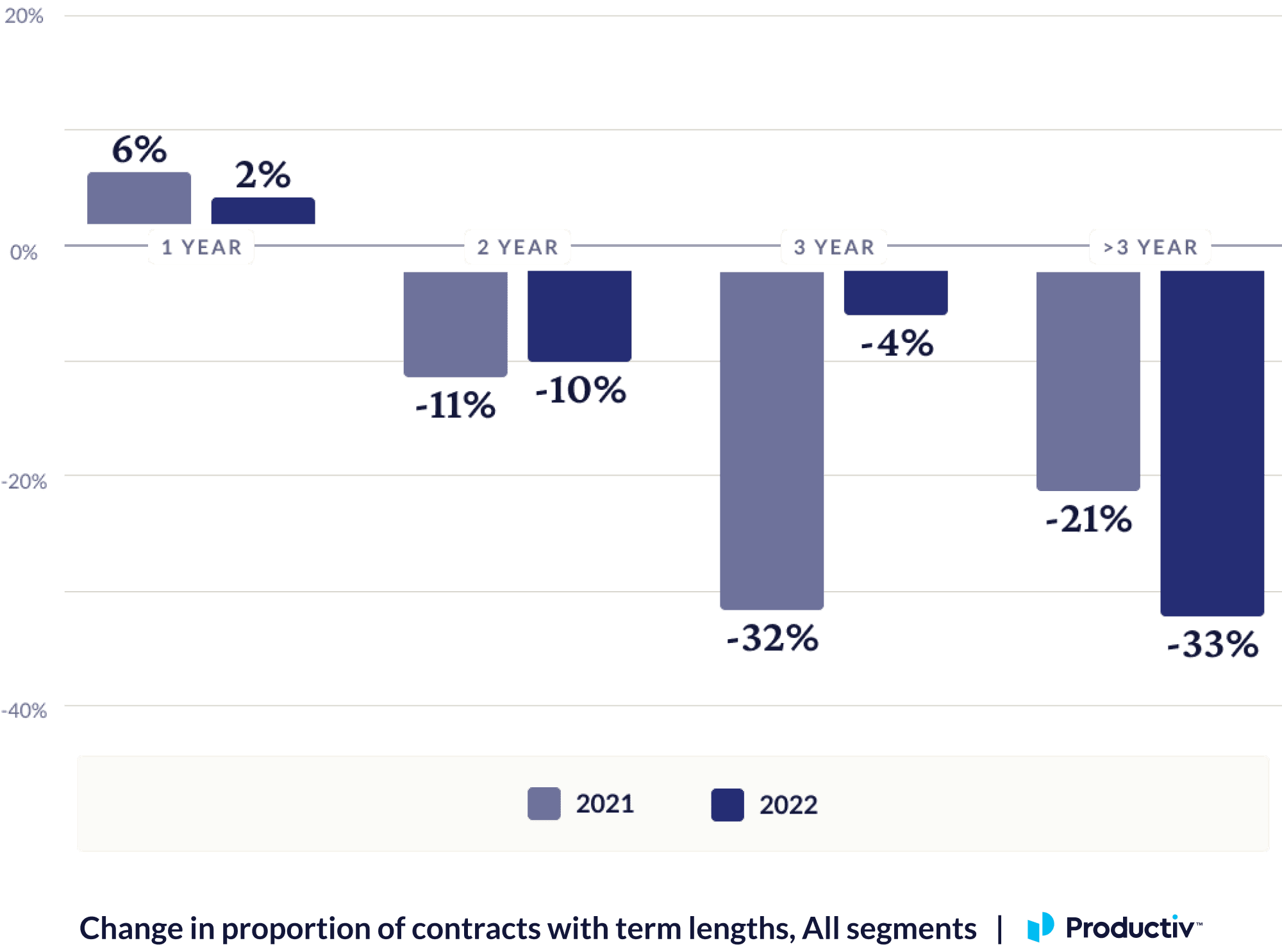

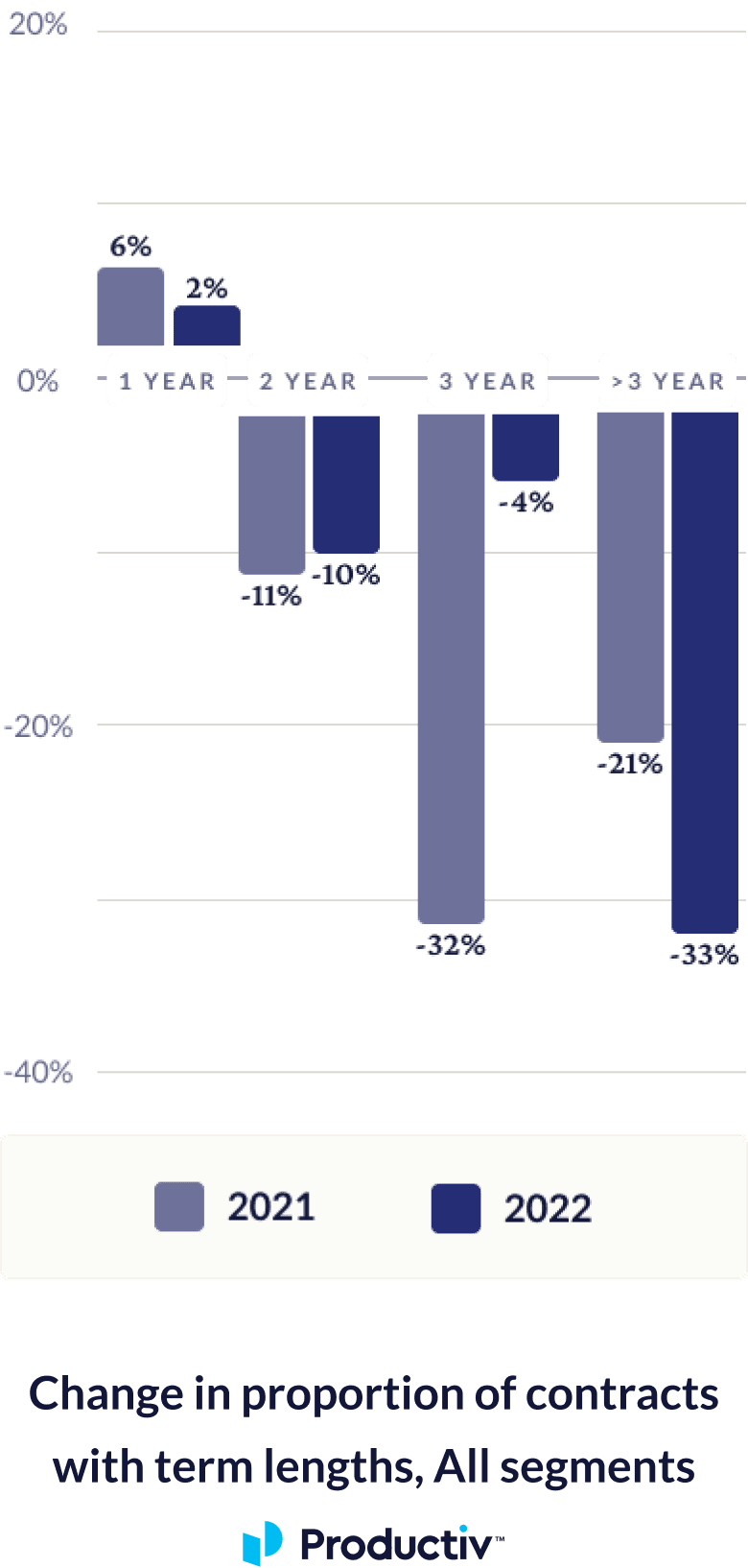

With the macroeconomic picture pushing organizations to reduce overheads, CFOs are driving more strategic initiatives to enhance oversight of their software spend. We found that the proportions of contract term lengths for SaaS agreements were shifting even before 2022 and continue to shift toward shorter term lengths.

In 2021 and 2022, work environments were moving from remote to hybrid. Many organizations wanted the flexibility of shorter contracts, allowing them to adjust their portfolios more quickly if their needs change. Shorter term contacts can also be less risky for businesses with fluctuating budgets.

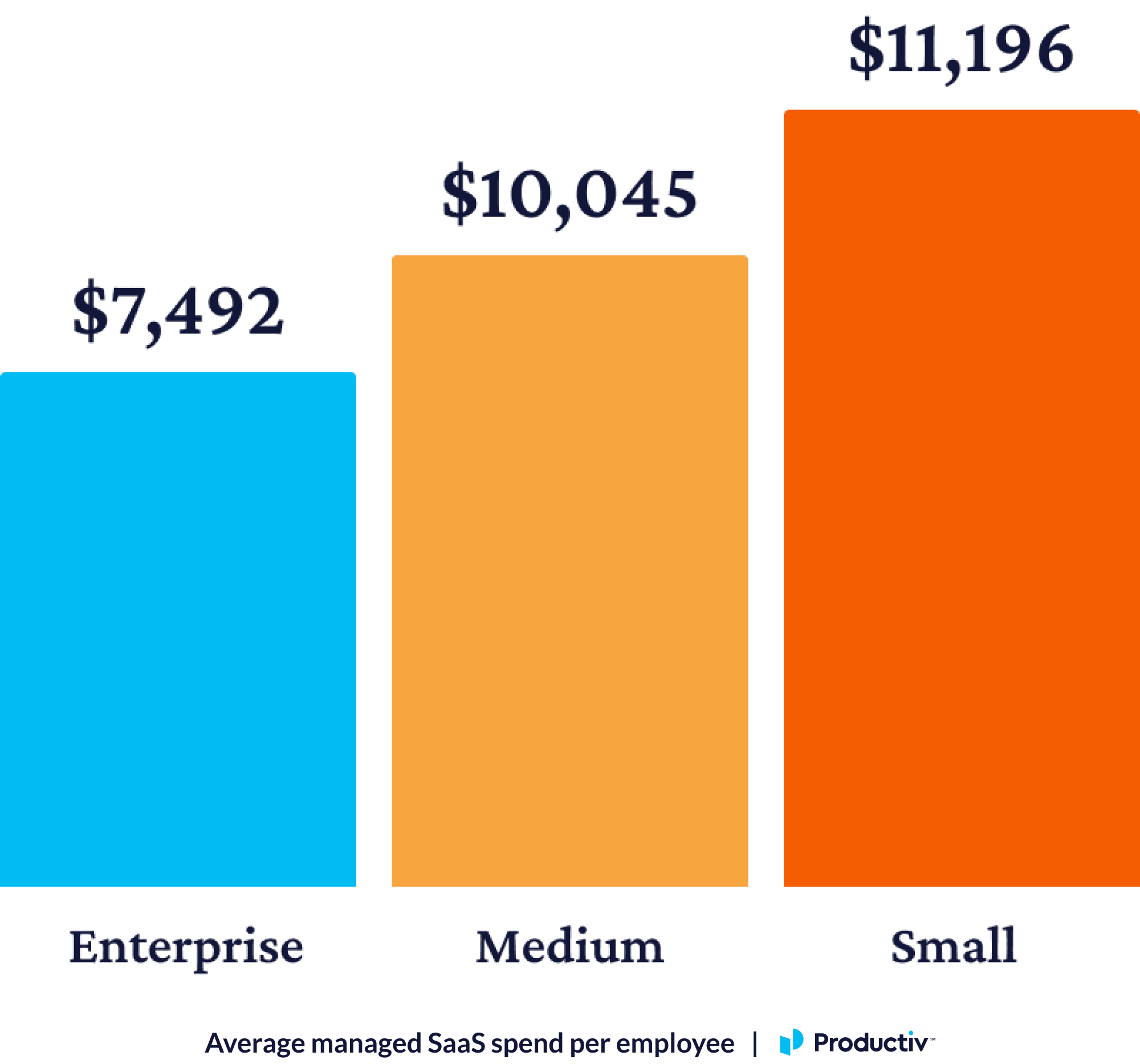

SaaS spend per employee averages $9,643, with enterprises spending less per employee

KEY TAKEAWAYS

- The small and medium-sized business (SMB) segment spent 11% more per employee than mid-market (MM) segment, who spent 34% more than the enterprise (ENT) segment.

- The inverse relationship between company size and SaaS spend per employee is likely driven by larger volume discounting and enterprise-wide licensing agreements, as well as efficiency of scale with consumption based SaaS apps.

Companies are signing more 1-year contracts than ever, up 79% of all contracts in 2020 to 85% in 2022

KEY TAKEAWAYS

- The proportion of 1-year contracts increased by 6% in 2021 and 2% in 2022.

- The proportion of contracts longer than 1 year declined relative to the previous year in both 2021 and 2022.

- The share of contracts with 3-year and greater than 3-year terms are declining the most, and their biggest slow downs happened at different times.

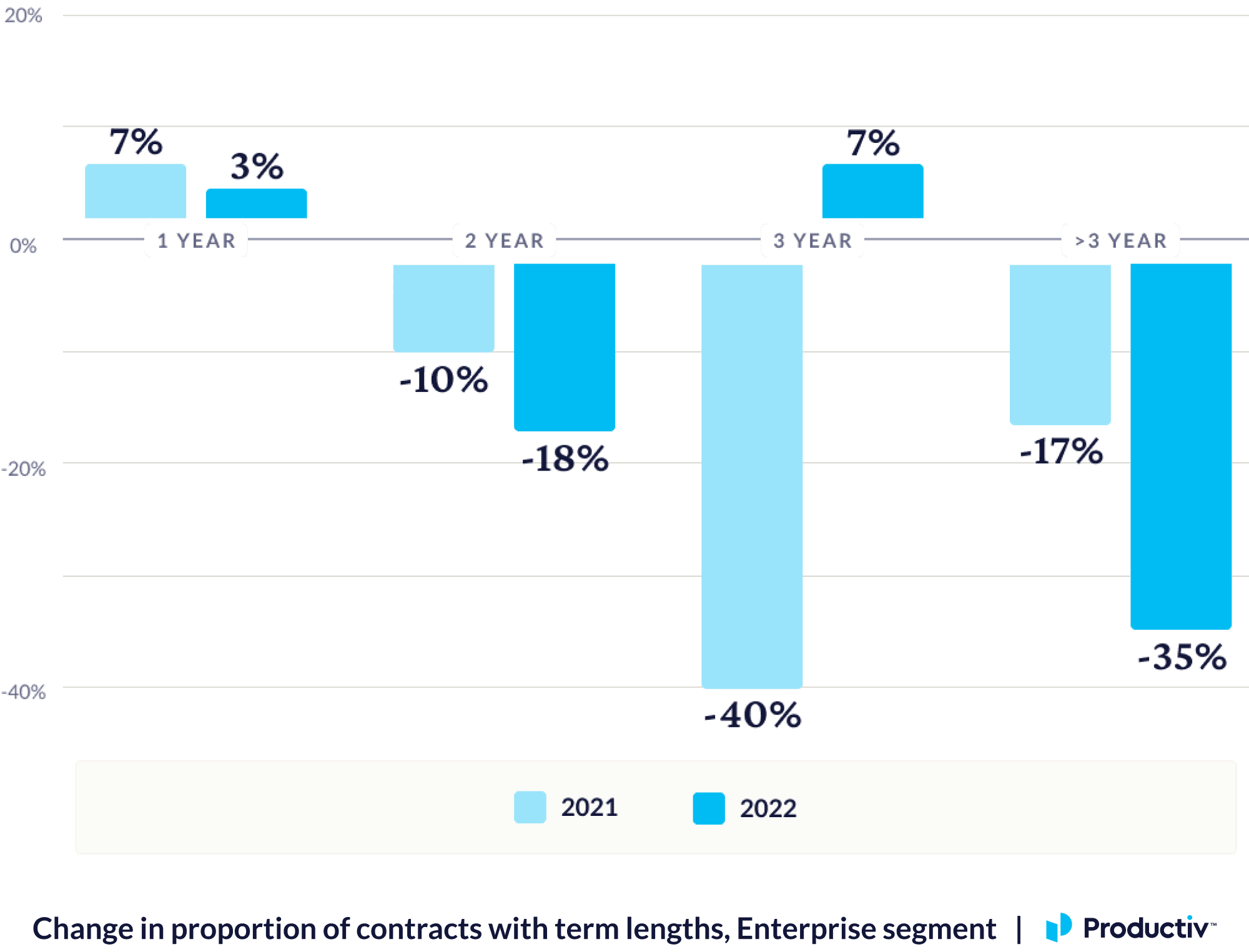

Enterprise

The proportion of contracts with a term of 3-years made a comeback with a 7% increase in 2022 after a 40% decrease in 2021

KEY TAKEAWAYS

- The enterprise segment had the largest decrease in the proportion of 3-year contracts in 2021, but it was followed by a rebound in 2022.

- The proportion of 1-year contracts increased more rapidly in the enterprise segment than the small and medium-sized business and mid-market segments for both 2021 and 2022.

- The proportion of contracts with term lengths greater than 3 years had the largest decline for any segment in 2022.

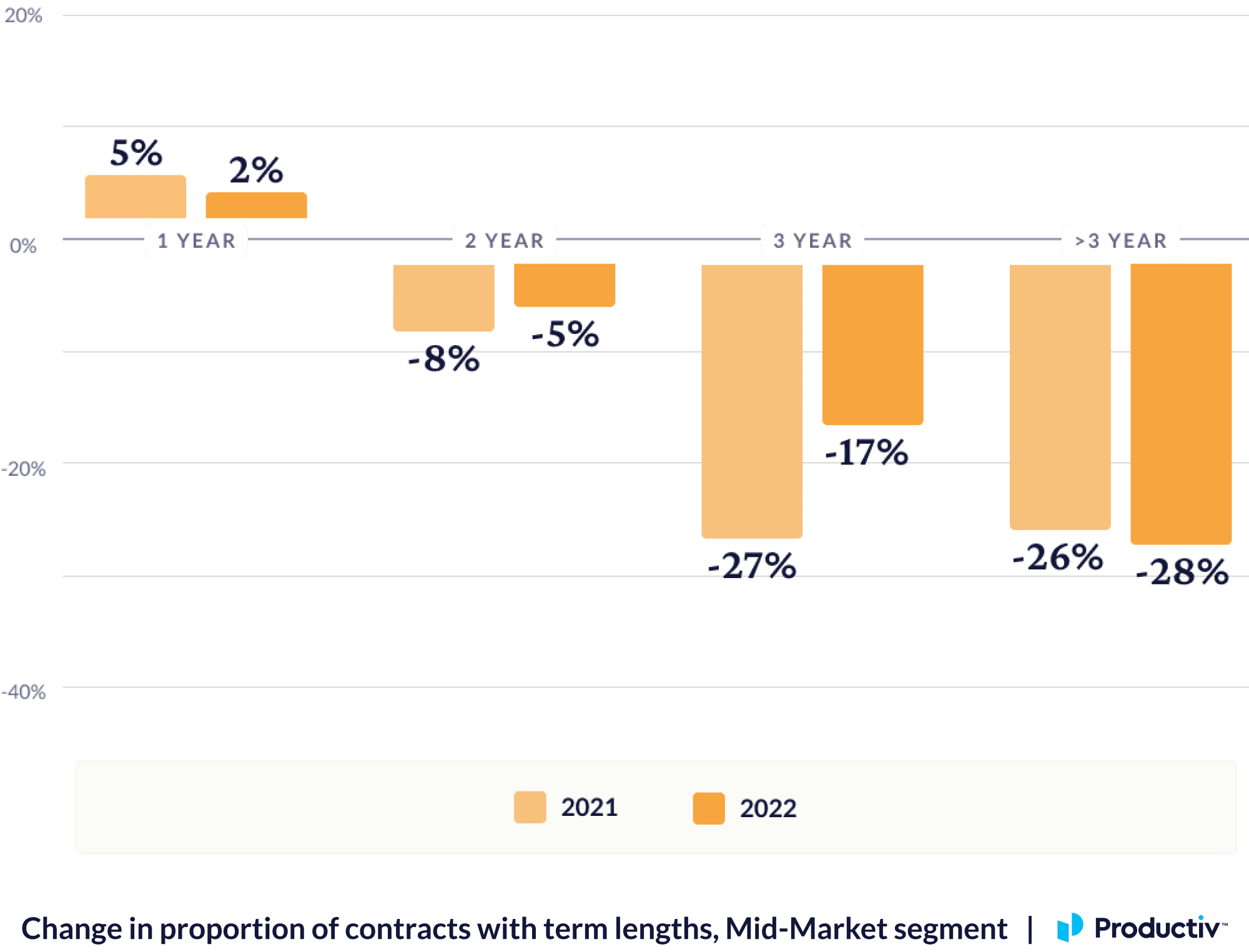

Mid-Market

The proportion of contracts that were 3-years and longer contracted by over 20% in both 2021 and 2022

KEY TAKEAWAYS

- Unlike the enterprise segment examined on the previous page, the mid-market segment continued to see a contraction in the share of 3-year contracts in 2022.

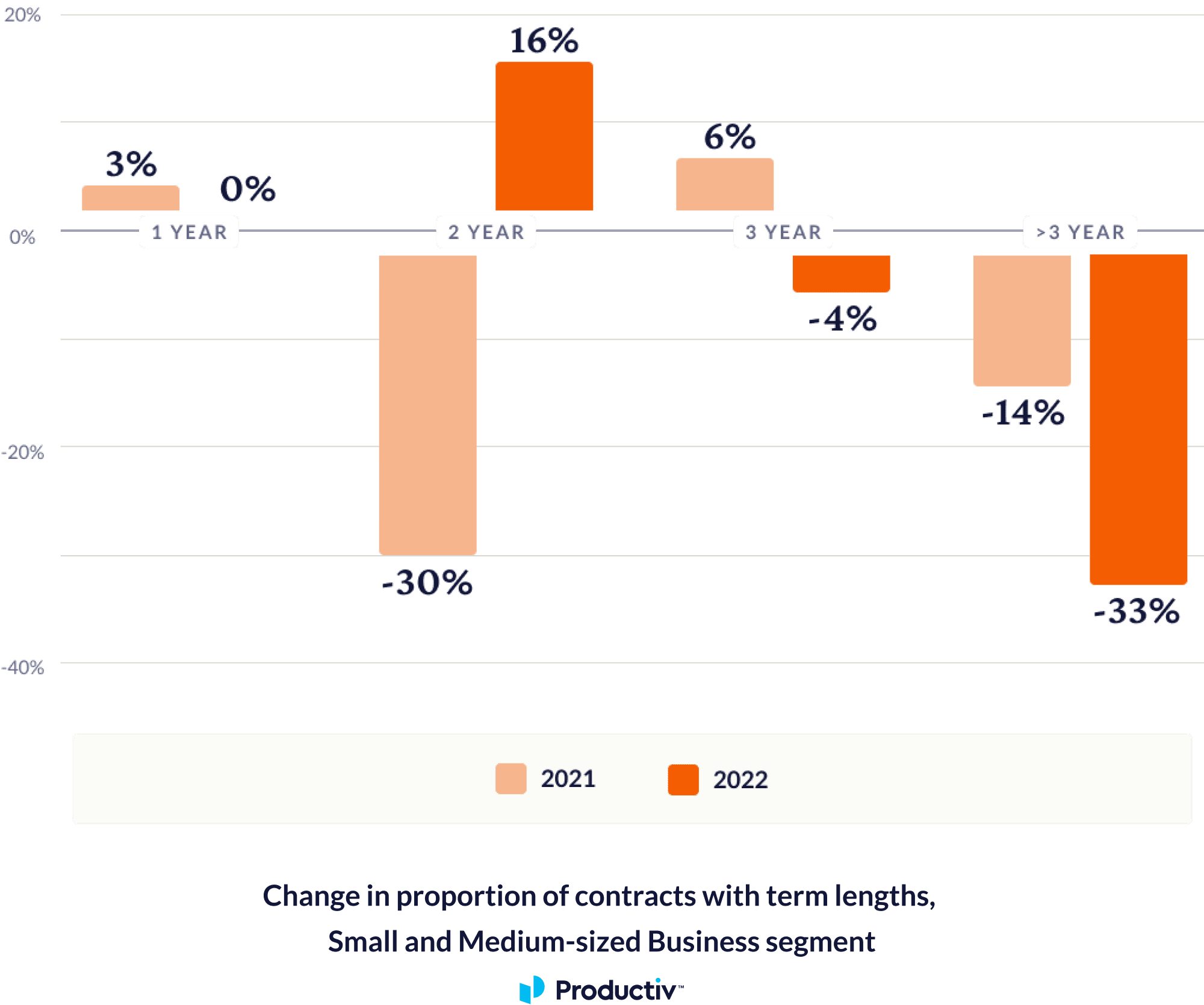

Small and Medium-Sized Business

The proportion of 2-year contracts rebounded significantly by 16% in 2022

KEY TAKEAWAYS

- The growth in the proportion of 1-year contracts was lower for the small and medium-sized business segment than for the mid-market and enterprise segments.

- In 2021, the proportion of 2-year contracts contracted and 3-year contracts increased, with a reversal of this trend in 2022.

Ready to explore more trends?

Currently Reading