2023 SaaS Trends – Growth

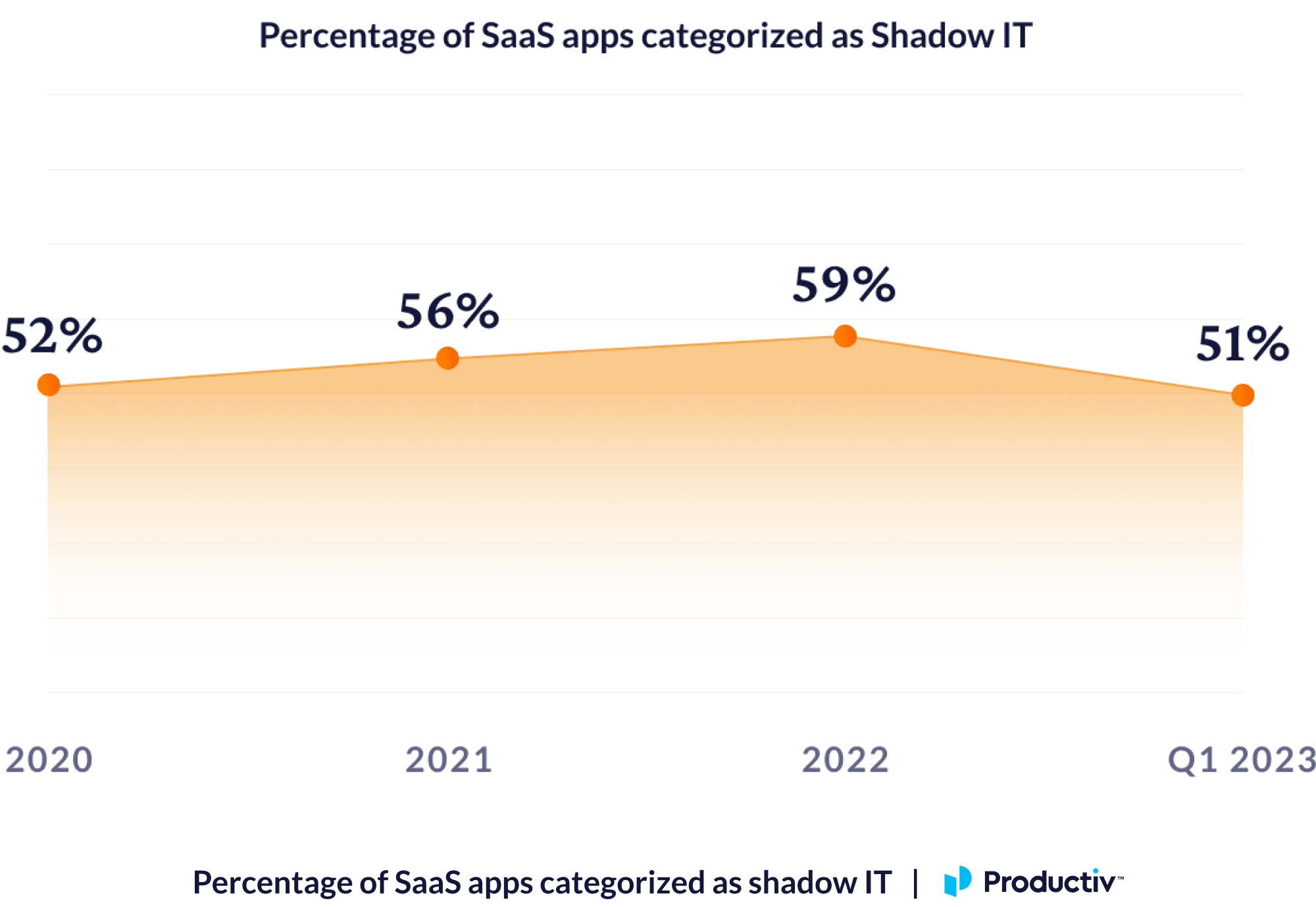

While the average SaaS portfolio grew 32% over the past two years, the percentage of shadow IT dropped for the first time in four years, from 59% to 51%, as companies hone in on greater SaaS governance and cost optimization.

SaaS Growth Trends

As SaaS portfolios grow, so does the need for effective SaaS governance. By establishing policies and procedures for the acquisition, deployment, and management of SaaS apps, organizations can ensure SaaS apps are providing value and not introducing avoidable risk.

But in order to effectively establish those policies, organizations must first gain full visibility to their SaaS portfolios. This includes shadow IT, SaaS apps that are purchased and expensed by employees without IT oversight. IT often lacks visibility into what these tools are, how much they cost, and to what extent they are used.

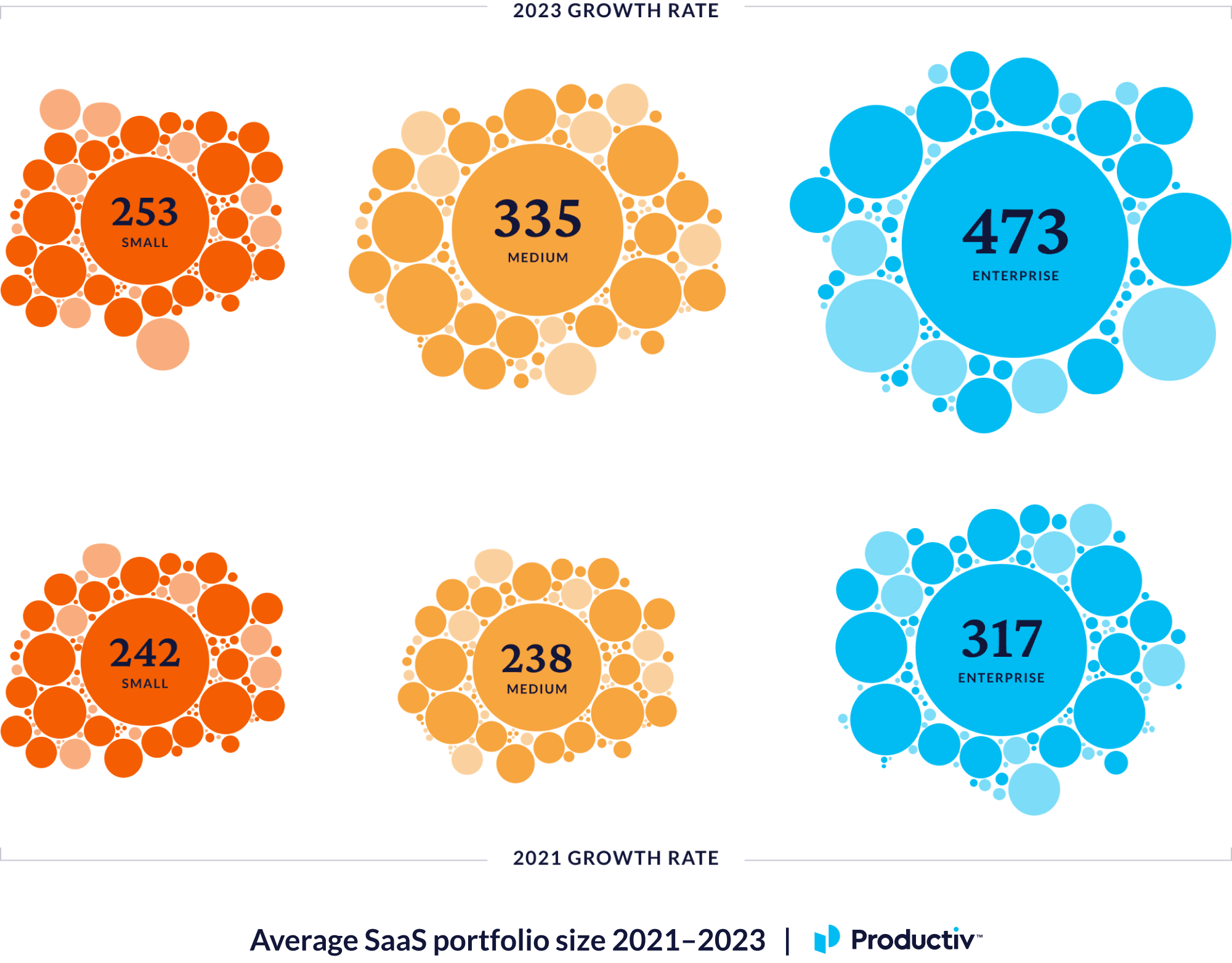

SaaS portfolio sizes reached an all-time high in 2023 with 371 SaaS apps in the average SaaS portfolio

KEY TAKEAWAYS

- Though the overall percentage of shadow IT decreased in 2023, SaaS sprawl continued as organizations and employees proceeded to purchase more SaaS apps to get work done.

- While all business segments saw increases in portfolio size, the percentage of growth was correlated to company size.

- Between 2021 and 2023:

- Enterprise portfolios increased 49%

- Mid-market portfolios increased 41%

- Small and medium-sized business portfolios increased 5%

Note: Small and medium-sized business (SMB) defined as <500 employees, mid-market (MM) between 500 – 2,000, and enterprise (ENT) >2,000.

The percentage of Shadow IT fell for the first time since 2020, from 59% to 51%, signaling an increase in SaaS governance actions

KEY TAKEAWAYS

- The percentage of SaaS apps identified as shadow IT consistently rose between 2020 and 2022 as companies rapidly grew and employees acquired their own tools to stay productive during times of remote and hybrid work.

- In 2023, this trend reversed as the shadow IT percentage dropped 8 points to 51%, the lowest it’s ever been over the last 4 years.

- Though organizations may still be hesitant to retire applications, as seen through the continued growth in portfolio sizes, this pullback in shadow IT is evidence of a stronger focus on SaaS governance. By establishing formal contracts with vendors, for example, organizations are hoping to increase their ability to control sprawl and excess spend.

- There is still work to be done as shadow IT continues to account for more than half of the applications in the average SaaS portfolio.

Note: “Shadow IT” defined as SaaS apps detected solely through a combination of Google Social Login and employee-expenses (e.g. Expensify, SAP Concur).

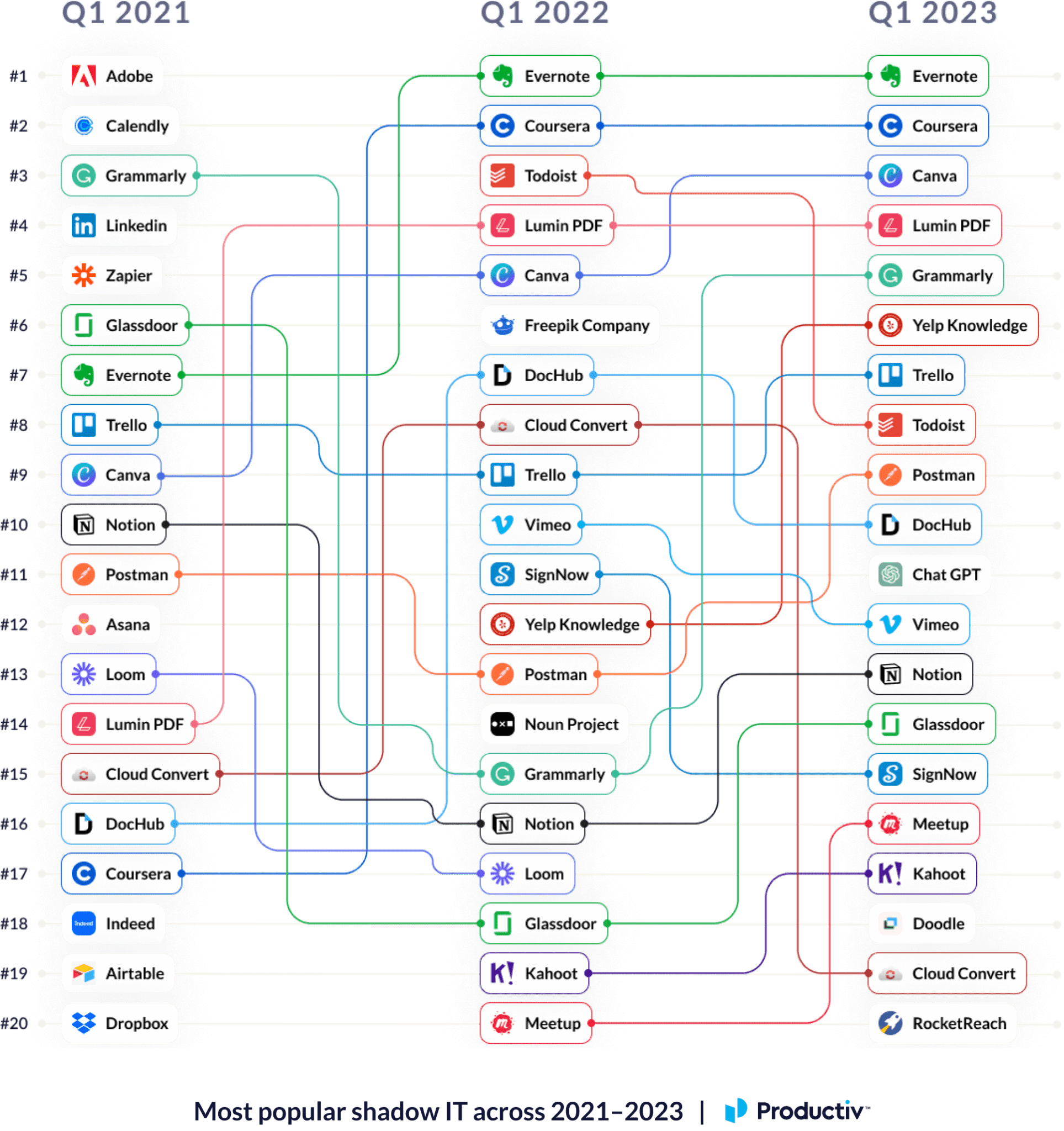

Shadow IT driven by a multitude of use cases; Evernote ranks #1 for two years straight

KEY TAKEAWAYS

- The note-taking and task management app Evernote appeared as shadow IT in the most number of organizations in both 2022 and 2023.

- The self-service design tool Canva increased in prevalence each year to become the third most popular shadow IT in 2023.

- ChatGPT burst onto the scene in 2023 and was quickly adopted by employees at many organizations.

- In addition to ChatGPT, the meeting scheduling tool Doodle and the lead generation tool RocketReach appeared on the top 20 for the first time in 2023.

Note: “Most popular Shadow IT” defined by number of customers with the app identified to be discovered through a combination of Google Social Login and expenses.

Ready to explore more trends?

Currently Reading