2024 SaaS Trends – Usage

Confluence was the overall most used SaaS application in 2024; tool proliferation continues, but overall governance initiatives are starting to prove effective.

The global economic climate continues to be in a state of flux. Corporations continue to face a mix of financial pressures, resulting in tough decisions and greater consolidation.

Executives have been tasked with narrowing down tech stacks in an effort get leaner — a response to both cost pressures and a desire for better efficiency.

But some businesses argue that growing their number of existing application allows them to take advantage of cutting-edge solutions — like Gen AI — just coming to market.

This quarter, discover the top used SaaS applications across all departments and keep a lookout for upcoming installations in the coming months.

SaaS Usage Trends

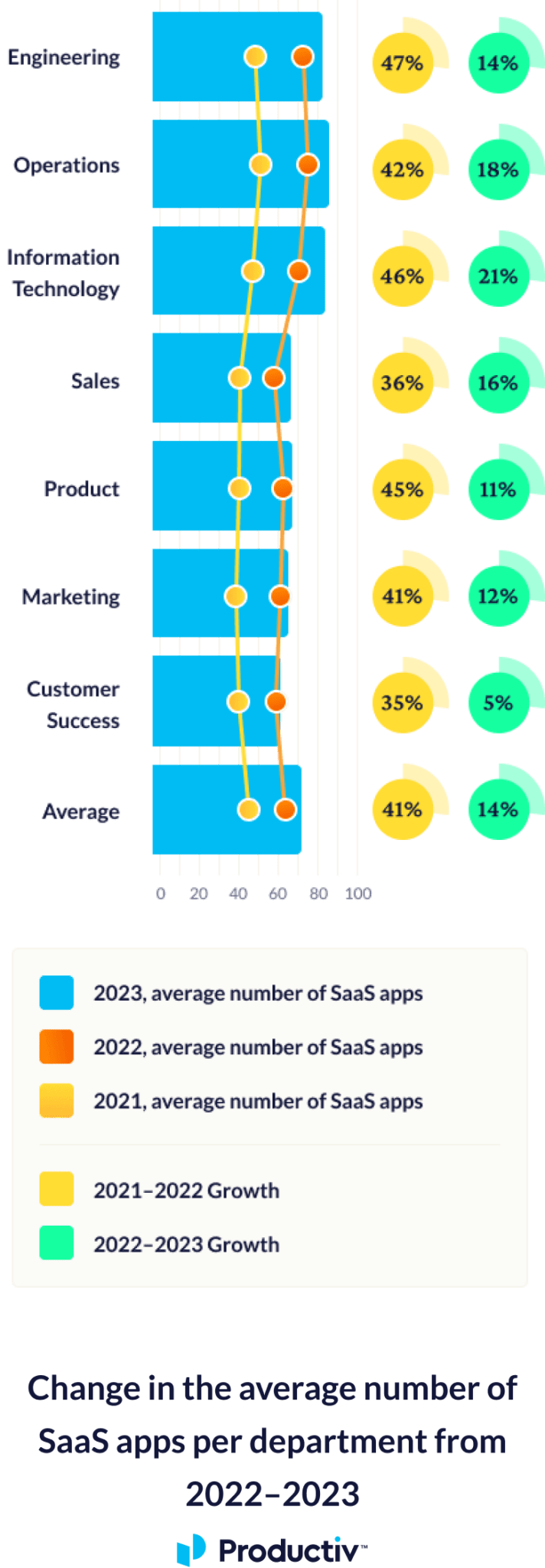

At the department level, the average number of SaaS apps used by each team grew by 14% to an average of 73 SaaS apps between 2022 to 2023. This is a notable change from the 2021 to 2022 numbers, which came in at 41% average growth and 64 apps respectively.

While absent from these usage charts, AI applications are expected to make a strong debut as businesses develop their AI policies and strategies over the coming year. This is indicated by employees rapidly adopting AI tools outside of their companies' governance policies as shadow IT applications.

The tools departments rely on are constantly in flux. From changing market dynamics to evolving business strategies and consistent technological innovation, there are many reasons why software gets adopted, renewed, or retired.

But what SaaS applications have departments been enthusiastically embracing, and which ones have fallen out of favor over the last few years? Let's dive into the data and discover the trends.

Average number of apps per team continues to grow; governance has slowed the rate

KEY TAKEAWAYS

- Tool proliferation continues, but overall governance initiatives are starting to prove effective, with the average growth rate of app adoption falling from 41% from 2021 to 2022 down to just 14% from 2022 to 2023.

- Operations as a department had the greatest increase in SaaS apps, increasing their average portfolio size from 74 to 87, despite having a lower growth percentage rate than IT, Sales, and Product teams. This is likely due to tool migration without ending prior contracts, or as a result of redundant tool usage.

- Customer success had the lowest percentage of growth — 5% from 2022 to 2023 — with only 61 average apps.

OVERALL:

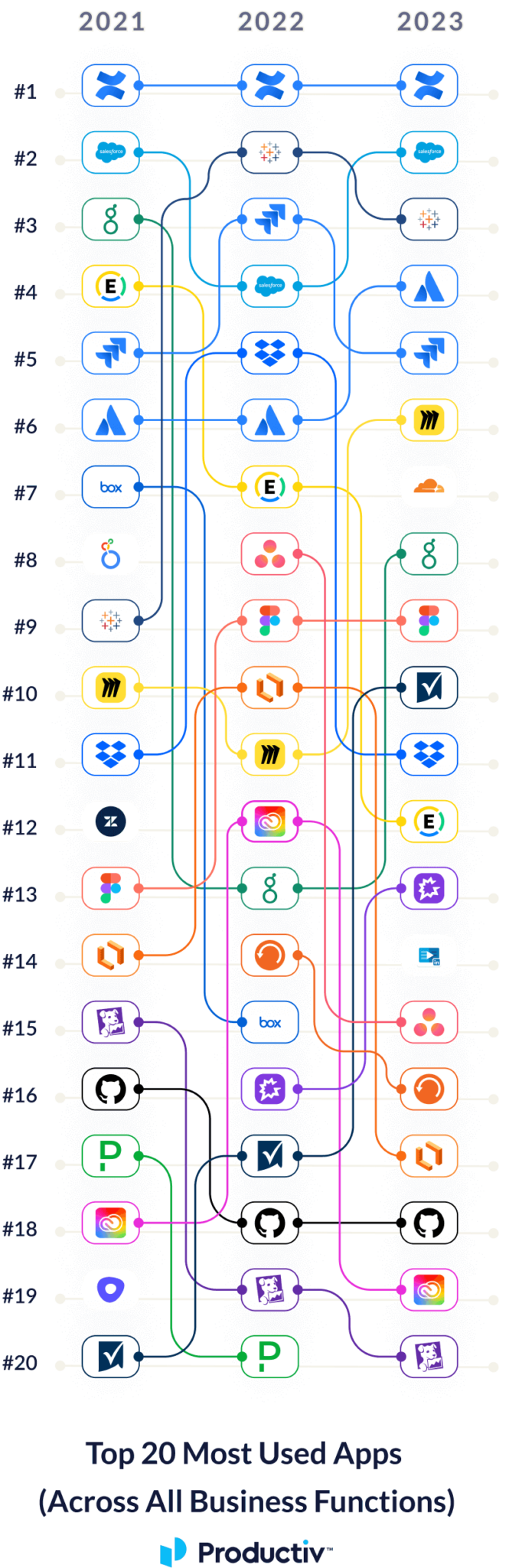

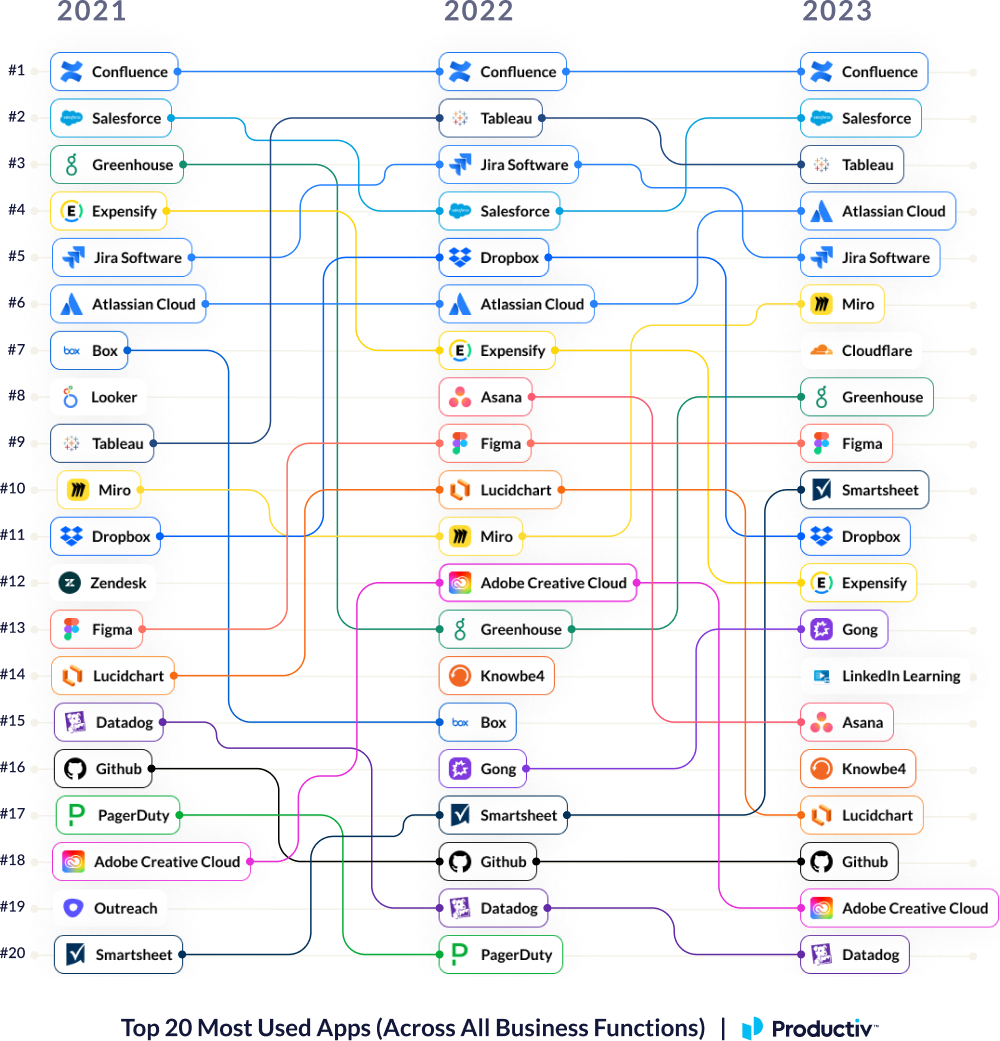

Confluence claims top spot in overall usage; collaboration proves key

KEY TAKEAWAYS

- Confluence showed consistent performance across all three years, continuing its reign in the overall top spot. Cross-department, the only application to beat it out was Salesforce, claiming #1 for Sales, Marketing, IT, and Customer Service teams.

- Increased usage of apps that boost collaboration — such as Figma and Miro — indicates that hybrid work is here to stay. Despite similar cloud-based offerings, Adobe Creative Suite fell in the ranks as users opted for a streamlined, cross-team experience.

- LinkedIn Learning joined the top 20 in 2023. As the workforce continues to be stretched thin, employees are saddled with more responsibilities and demand for new skills in order to keep up with growing job requirements.

- Applications with company-wide adoption — like Cloudflare (security), Knowbe4 (securities training), and Greenhouse (recruiting) — can also be seen in the top 20, demonstrating strong IT governance strategies at work.

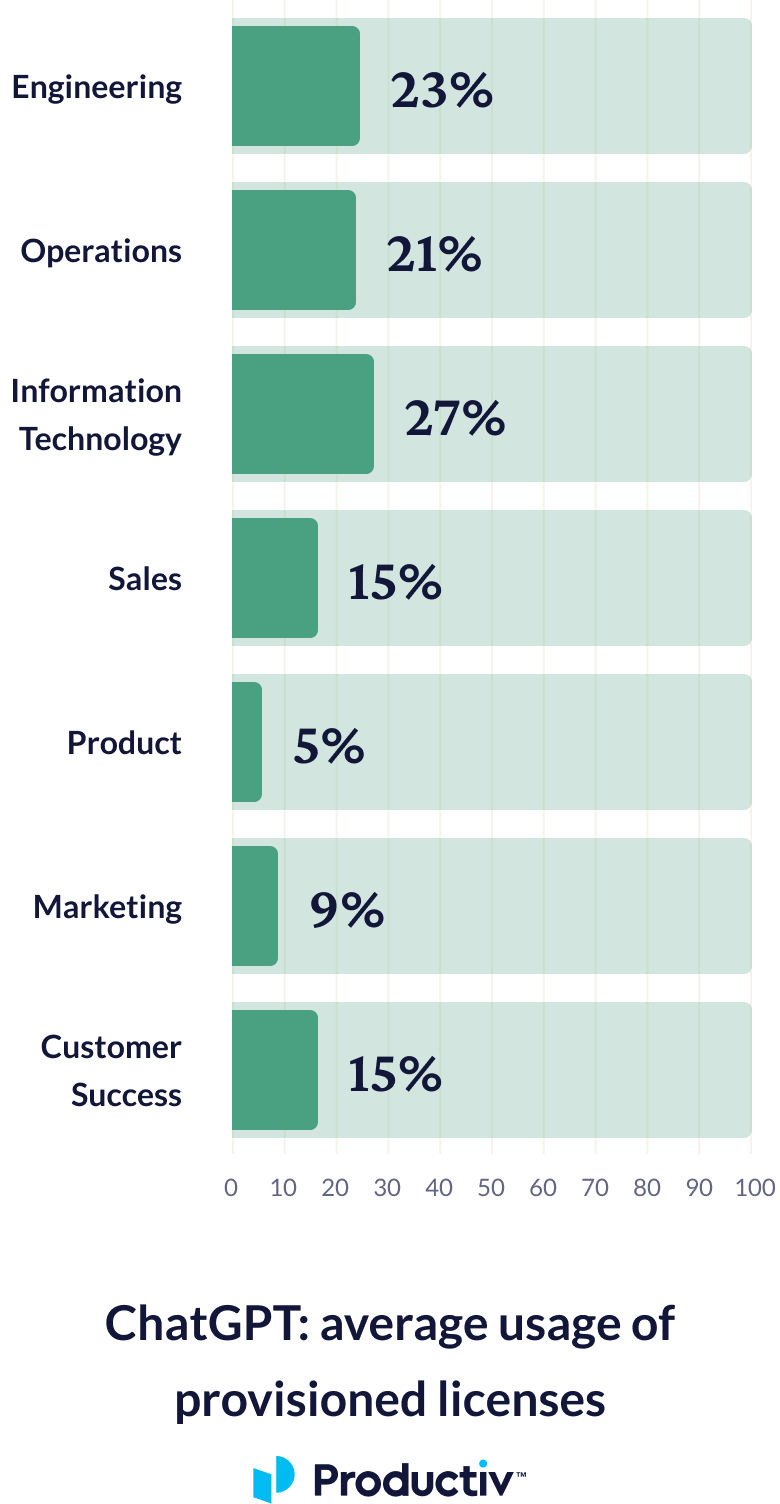

AI USAGE TRENDS:

New strategies aim to shift AI tools from shadow IT to be managed under policy; IT tests ChatGPT adoption

KEY TAKEAWAYS

- While the top players in the space continue to claim spots in the top 20, expect to see a massive shift in the next year, as more AI applications are shifted from shadow IT and brought into policy. To see the data on shadow IT and AI, check out the State of SaaS - Growth report.

- ChatGPT’s — the most used shadow IT application of 2023 — performance highlights how IT is testing out strategies to bring AI applications into policy.

- However, overall usage of approved ChatGPT licenses is low. IT is struggling to gain formal license adoption — demonstrated by the over provisioning of licenses — despite shadow IT proving employee interest and use.

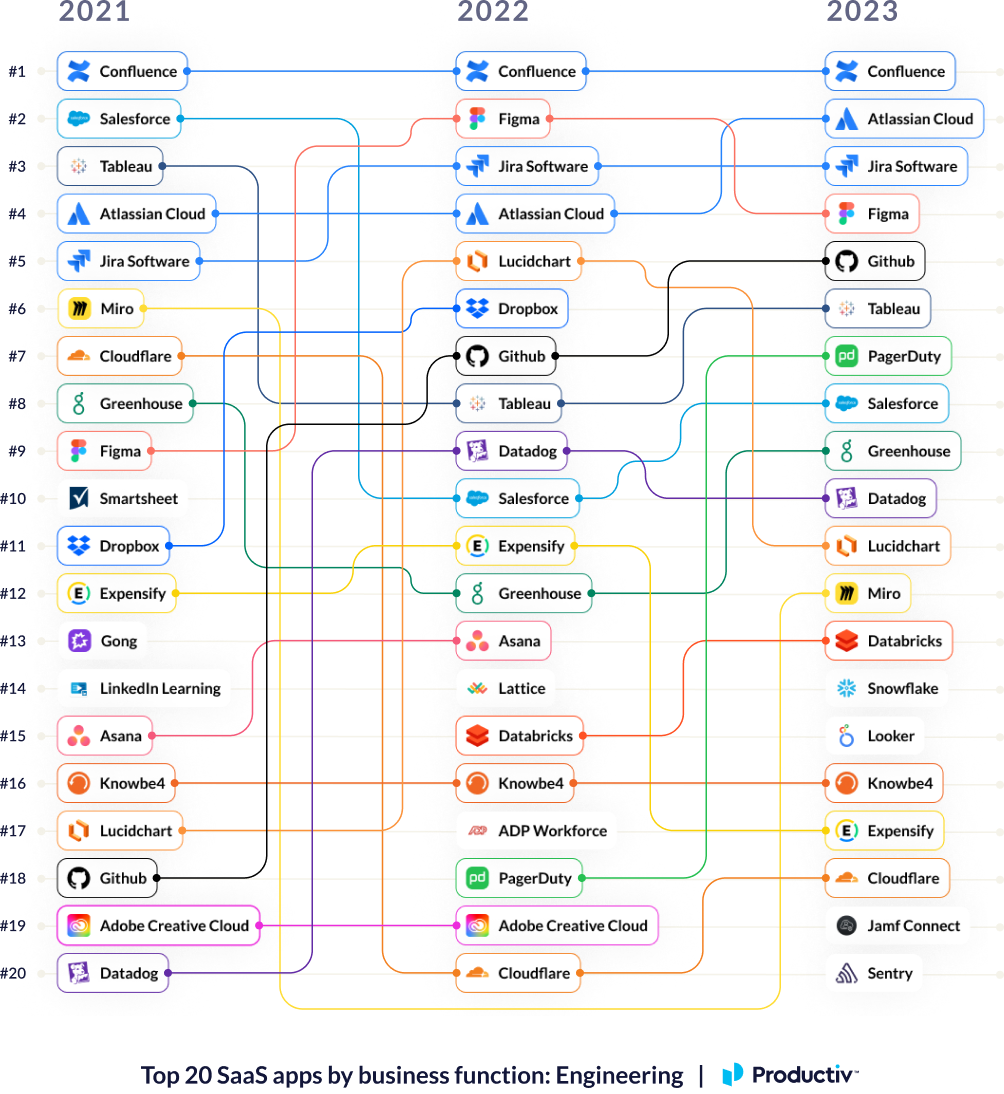

ENGINEERING:

Data security marked as high priority; Confluence holds top spot

Key Takeaways:

- While it’s been an industry standard tool for quite some time, PagerDuty’s jump from #18 to #7 exemplifies how companies are prioritizing the security of their — and customer — data. Companies are looking for a more streamlined alerting process and are now more proactive than ever as a result of the current litigious atmosphere.

- Figma — though dropping from #2 — maintains a spot in the top 5 as the tool moves away from being a siloed design tool, instead increasing focus on fostering collaboration between designers and developers.

- Jira proves to be the preferred project management tool for Engineering. This preference also helped to secure its spot with Product and Operations, streamlining projects cross-department.

- Salesforce’s custom coding functionality cements its spot on the list as companies prioritize adapting applications to best fit their needs.

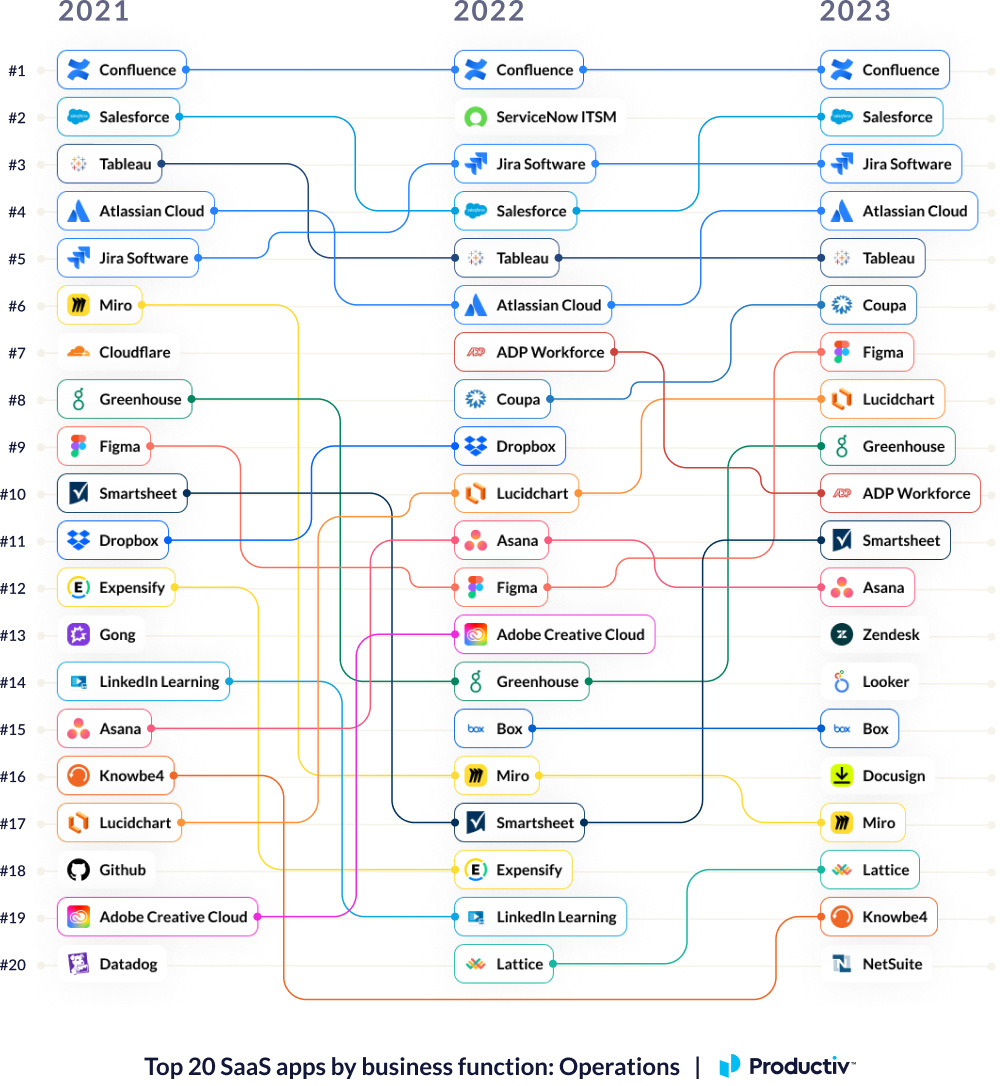

OPERATIONS:

Project management is personal; battle for the top PM tool continues

Key Takeaways:

- Project management tools continue to be a hot button issue, with employees each having a personal preference on their tool of choice. This often causes an influx of tool proliferation as individuals adopt the department tool of choice while continuing to use theirs. Jira, Asana, and Smartsheet’s performance reflects this trend, with Jira landing at number 3 due to departmental preference.

- Zendesk, Looker, Docusign, and Netsuite’s addition to the 2023 top 20 reflects a desire for more self-serve SaaS applications within a tech stack.

- Operations had the highest number of SaaS applications in their stack.

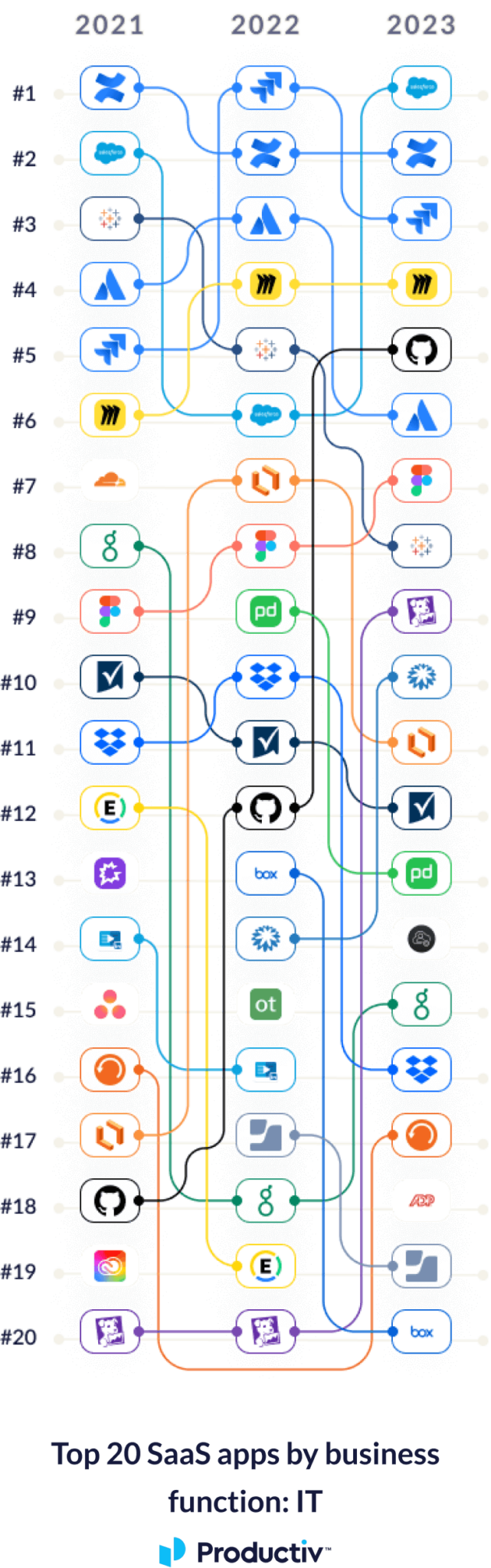

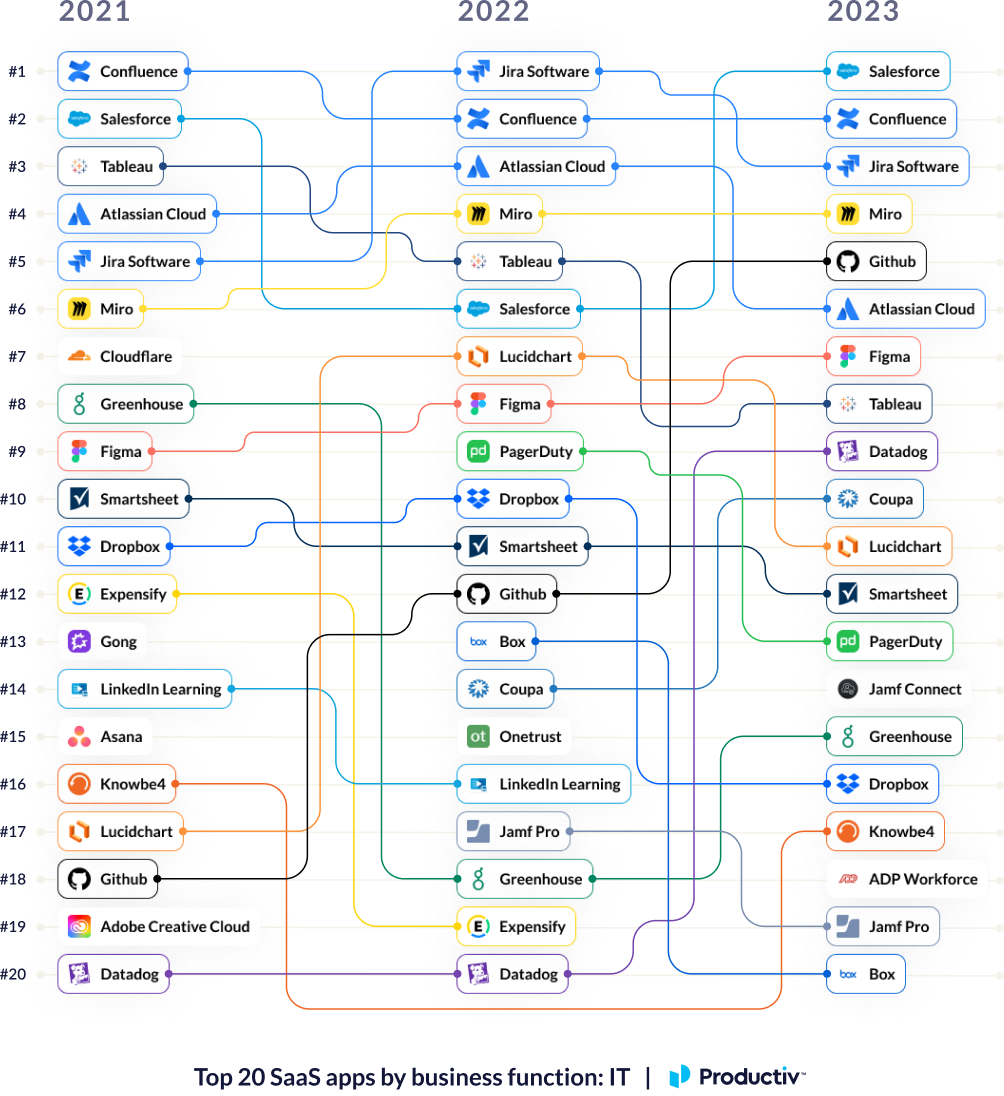

INFORMATION TECHNOLOGY:

Strong preference for product suites; better app consolidation

Key Takeaways:

- Outside of some specific function tools (Knowbe4, Greenhouse) and collaboration and file storage apps (Miro, Figma, Box, etc.) most tools in the top 20 are product suits that address multiple use cases. This indicates a strong preference for tools that allow for better app consolidation.

- This trend can also be seen in Datadog’s performance, springing from #20 to #9 between 2022 and 2023. Their growth can likely be attributed to their continued development of a full suite of services to help with app and cloud management.

- Salesforce jumps from #6 to claim top spot. As more companies continue to leverage Salesforce, IT is tasked with administrating it.

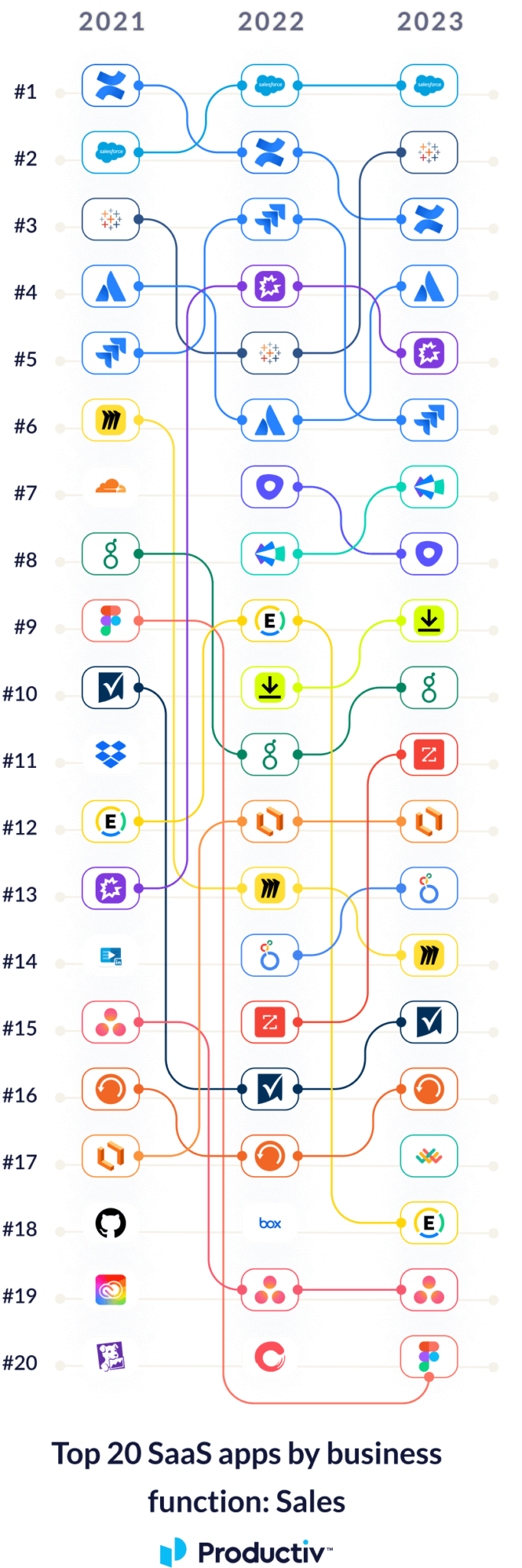

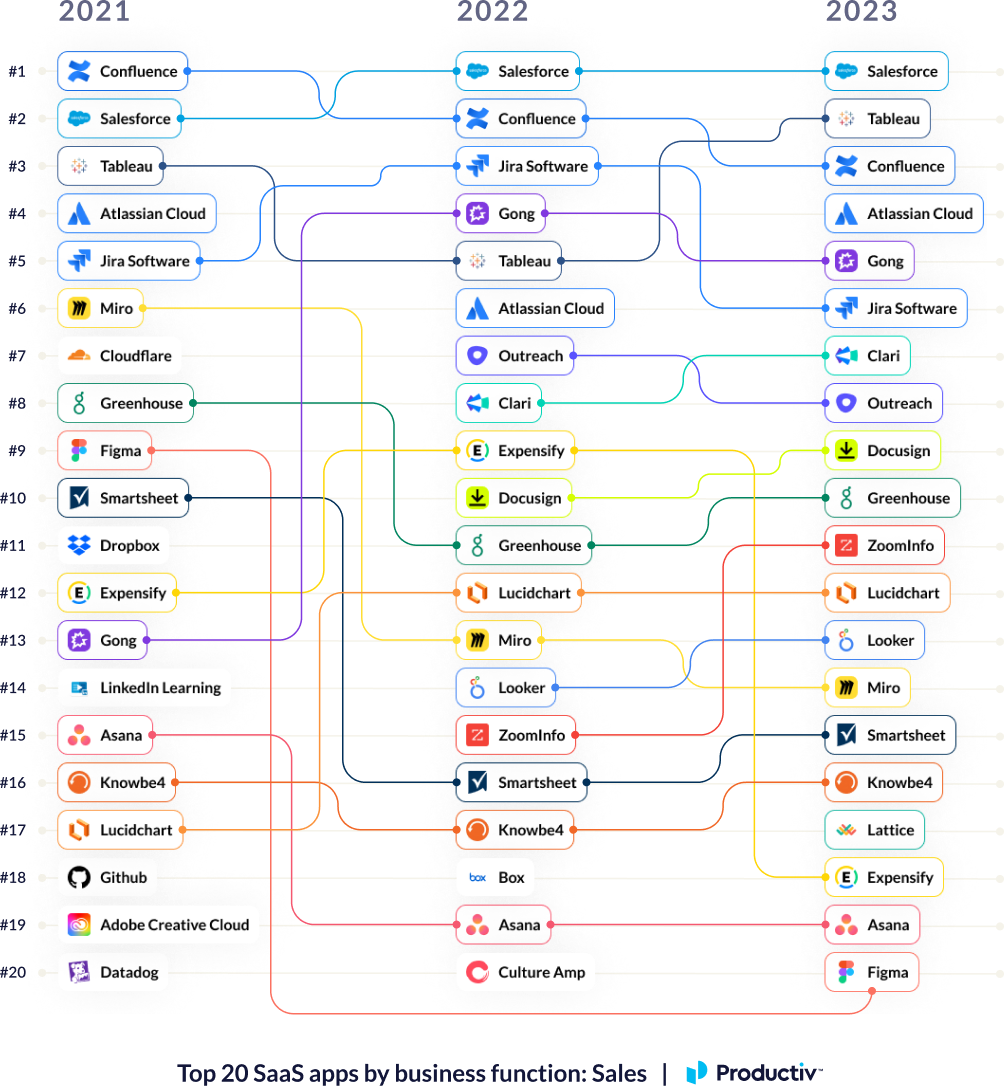

SALES:

Salesforce remains at the top; Expensify drop reflects tight budgets

Key Takeaways:

- Sales teams demonstrated one of the highest rates of app turnover. Eight apps have dropped out of the top 20 since 2021. The shift in applications is aligned with the desire to consistently try new strategies as the importance customer acquisition remains a top priority for all businesses.

- The top 20 primarily consists of tools to support the sales cycle (sourcing, tracking, contracting) and collaboration tools for building content for customers.

- Expensify appeared all three years, but dipped in 2023 as a result of tighter budgets.

- Figma fell out of the top 20 in 2022, only to reemerge on the 2023 chart as cross-team collaboration continues to be prioritized.

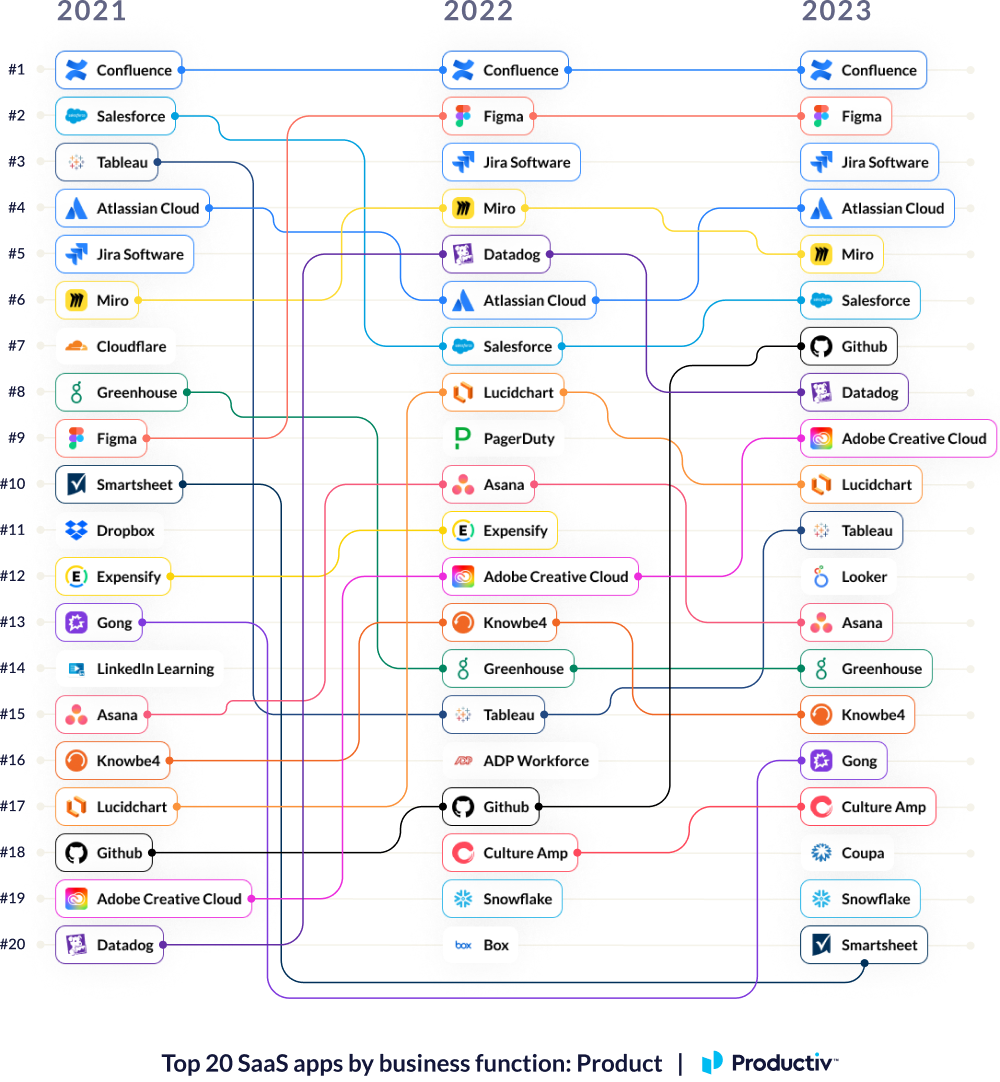

PRODUCT:

Growing desire for cross-team collaboration; GitHub jumps 10 spots

Key Takeaways:

- Cross-team alignment remains a top priority for Product, with its top 20 consisting of applications with collaborative features at the forefront.

- GitHub jumped from #17 to #7 likely as a result of stronger collaboration between Product and Engineering departments. It also signals that build teams are taking on more responsibility, feeling the pressure of skeleton-crew teams.

- Feedback is of the utmost importance — while Gong dropped out of the top 20 in 2022, it reemerged at #17 as Product teams lean into customer perspectives.

- Looker appeared at #12 in 2023, reflecting an ever growing desire for data.

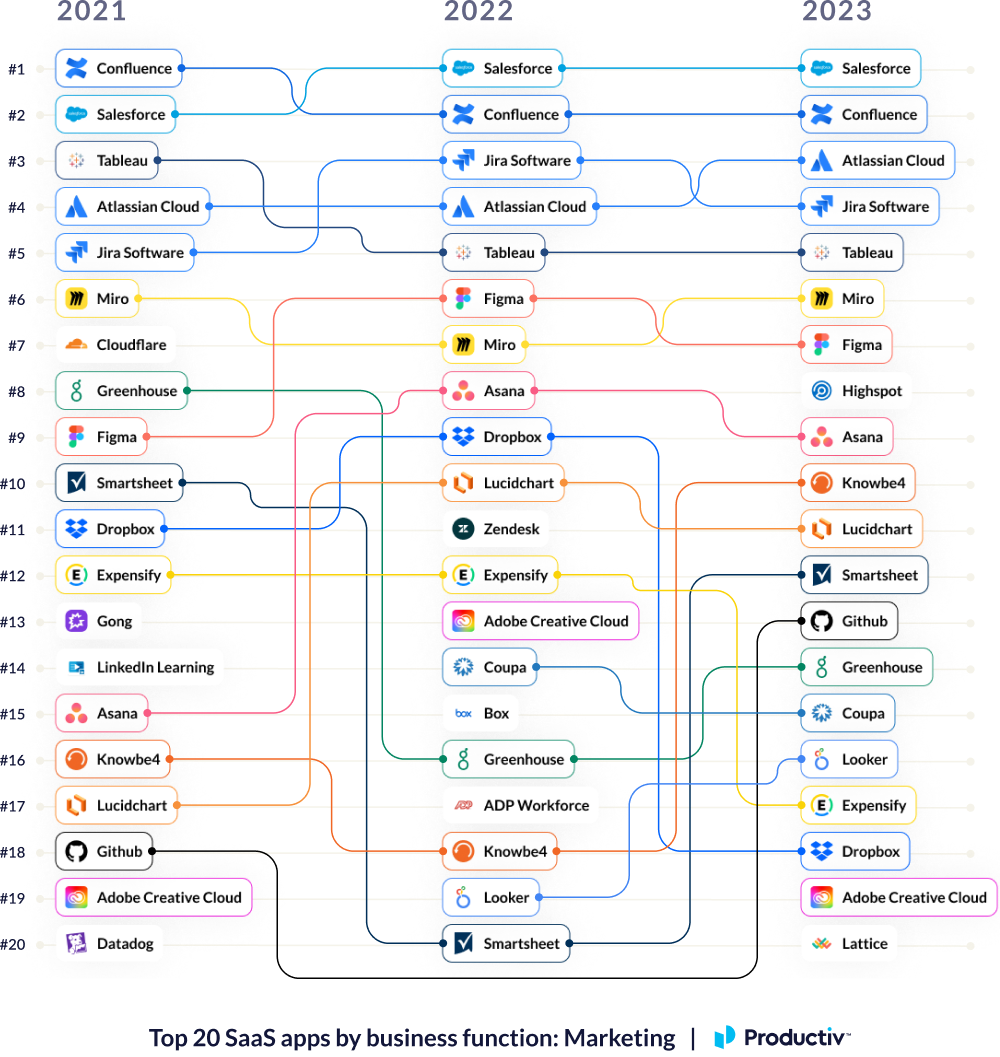

MARKETING:

Year-over-year, marketing favors project management and collaboration.

Key Takeaways:

- Salesforce and Confluence — which enable knowledge sharing between Sales and Marketing — claim the top two spots for two years running, with Atlassian Cloud, Jira, and Tableau rotating within the top 5.

- Highspot makes a strong debut at #8, as Sales Enablement remains a key priority for Marketing teams.

- GitHub jumps back into the top 20 as Product Marketing Managers continue to require close knowledge of product status and offerings.

- Figma and Miro continue to fight it out for the #6 spot, again boasting their collaborative offerings, while Adobe Creative Cloud, despite strong performance in 2022, drops down to #19.

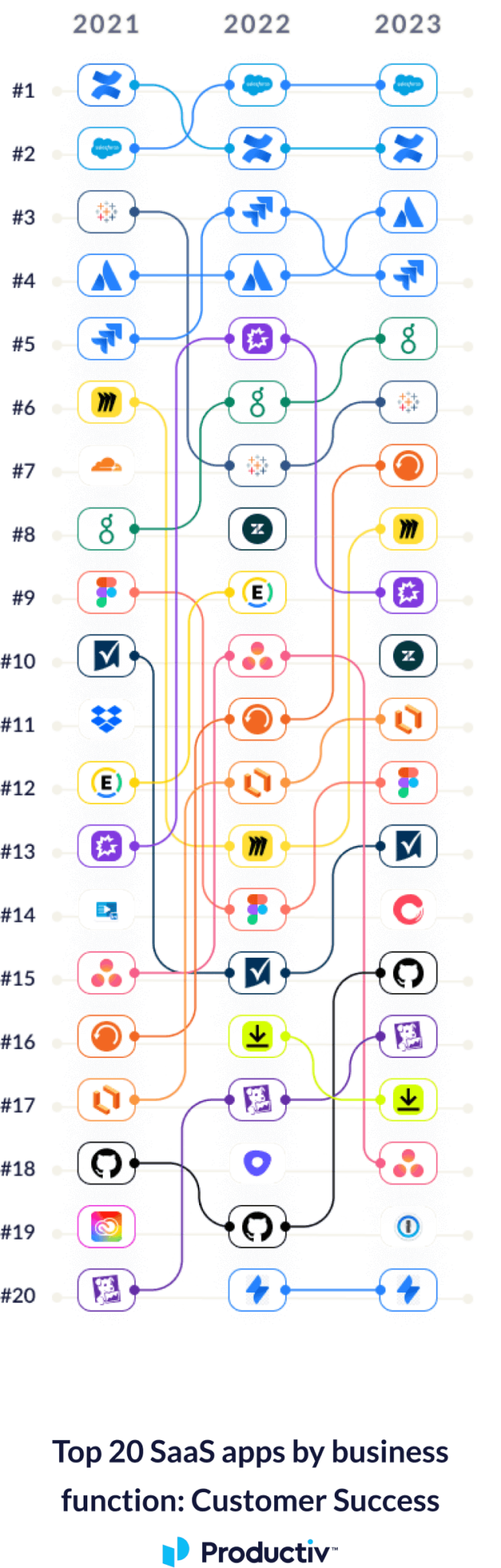

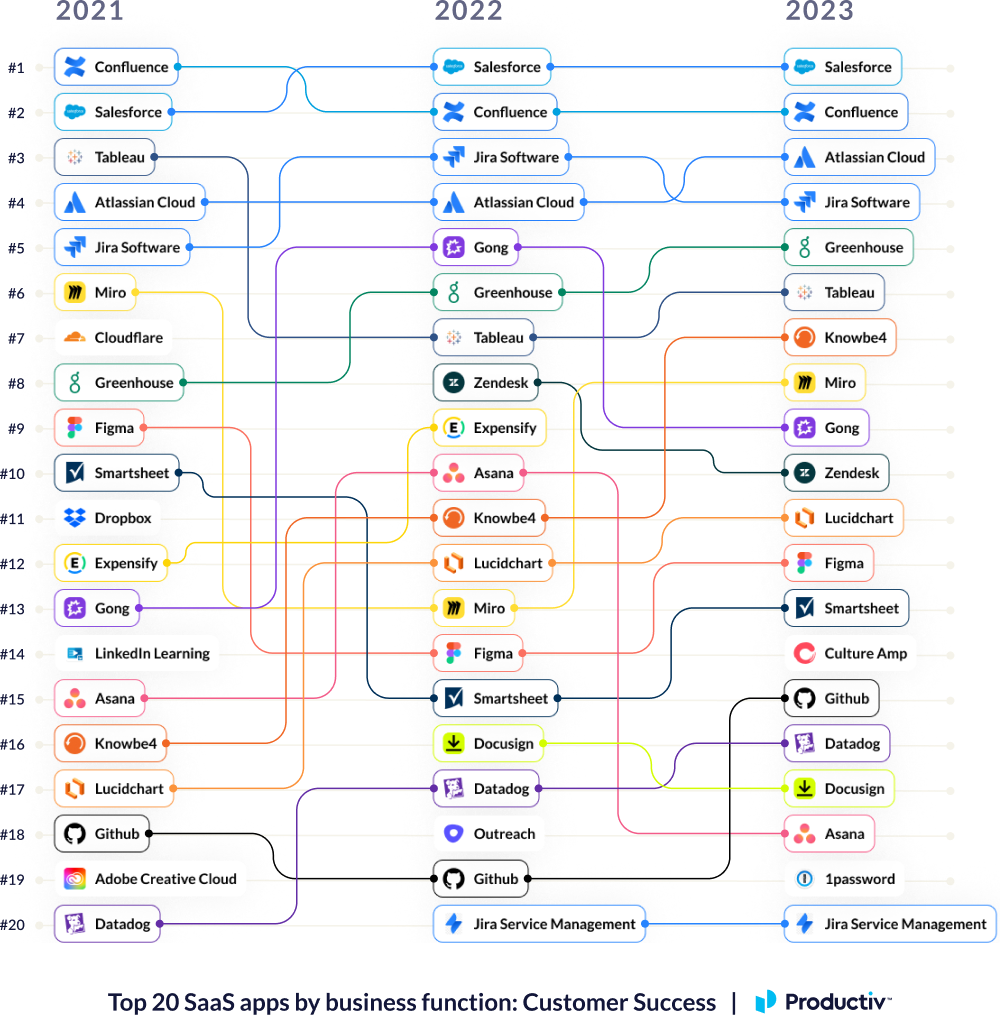

CUSTOMER SUCCESS:

Consistency mirrors success: Same 4 apps claim top spots between 2022 and 2023

Key Takeaways:

- Greenhouse claims #5 spot — higher than any other department — as acquiring top talent is a key factor in ensuring customer happiness.

- 1password debuts on the chart at #19. As Customer Success teams constantly manage external facing platforms and large amounts of customer data, ensuring security is a top priority.

- Culture Amp appeared for Customer Success and rose on the Product chart in 2023, as the teams continue to work closely on shared goals.

To learn more about the report methodology,

Ready to explore more trends?

Currently Reading