2024 SaaS Trends – Consolidation

An average of 40% of SaaS licenses are still going unused, with low adoption rates persisting. Consolidation can be seen across all app categories; Security & Compliance applications make up the majority of the average tech stack.

The global economy continues to be as volatile as ever. From the steep rise and fall of the stock market, to the “will they, won’t they” speculations of a recession, business leaders are more focused than ever on cost reduction and risk mitigation.

While the average tech stack has been intentionally chopped over the last few years, executives continue to look for ways to maximize the value of their SaaS applications.

Whether they’re focused on consolidating their portfolios or increasing adoption of new and existing apps, the focus on better governance is a direct response to the current market conditions.

SaaS Consolidation Trends

While there is a concerted effort to consolidate SaaS applications and rightsize licenses — the number of SaaS apps per key category decreased by 7% in 2024 — whittling down a tech stack won’t solve for low adoption rates. Overall license adoption only increased by less than 1%, leaving significant room for improvement as businesses leaders adjust their SaaS management strategies.

Once you gain full visibility into the SaaS apps departments are using, how they use them, and how much they cost, you can start to identify opportunities for rationalization through license rightsizing and SaaS app consolidation.

The desire to reduce the size of application portfolios has led to a decrease in the number of SaaS apps adopted by every department since 2022. The focus on risk mitigation is reflected in the desire for Security & Compliance applications and the consolidation of apps across all categories.

As seen in the other 2024 State of SaaS installments, implementation of strategic governance has resulted in smaller tech stacks, but the battle against license waste is still going strong. While there continues to be a focus on rationalization, companies still have a long way to go.

Let's dive into the data and discover the trends.

APPS PER CATEGORY:

How many apps is too many apps?

Security & Compliance apps, 2x any other category

KEY TAKEAWAYS

- App consolidation can be seen across the board, with an average of one app per category cut. Low license adoption is likely attributed to the high number of apps that remain in each category. Operating with 9 project management applications, for example, is a recipe for employee confusion and low usage.

- With the average cost of a data breach rising to $4.88M in 2024, companies will continue to prioritize Security & Compliance applications — the largest app category in the average tech stack — to mitigate risk for their business.

- Between 2023 - 2024, the number of SaaS apps in the top 20 categories saw a decrease of 7%, a sharp course-correction from the 2% increase seen the year prior.

- As teams face tight budgets, they will continue to favor lean app portfolios; they’ll look for applications that provide greater value, reduce risk, and require less effort to manage.

- For additional segments, please refer to the appendix

AVERAGE LICENSE ADOPTION:

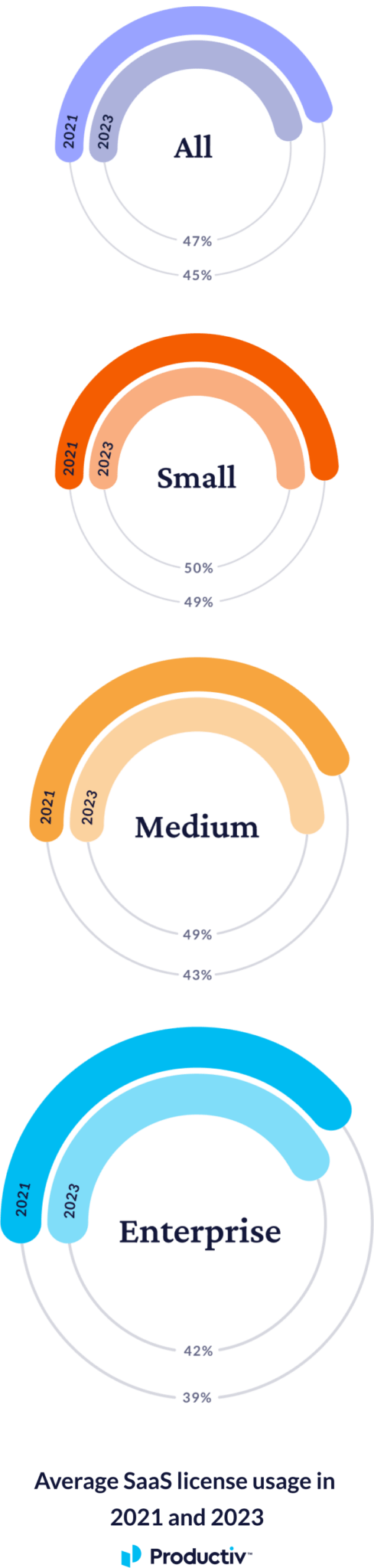

40% of licenses are still going unused, on average; SMB has the highest rates of adoption for SaaS licenses

KEY TAKEAWAYS

- A minimum of 30% of licenses are going unused, that number reaching as high as 41% for enterprise (ENT) businesses. Despite concerted efforts to strategically consolidate applications and encourage adoption, companies continue to see wasted spend on applications.

- Small and medium-sized businesses (SMB) boast the highest rate of adoption, with 70% of apps in their portfolio consistently in use.

- Despite the difference in size, ENT and mid-market (MM) companies only had a 1% variation in adoption in 2024

- MM took the biggest hit in adoption, dropping 7% since 2022. Businesses of this size often struggle with analysis paralysis as they shift from a start-up mindset to operating at an enterprise level.

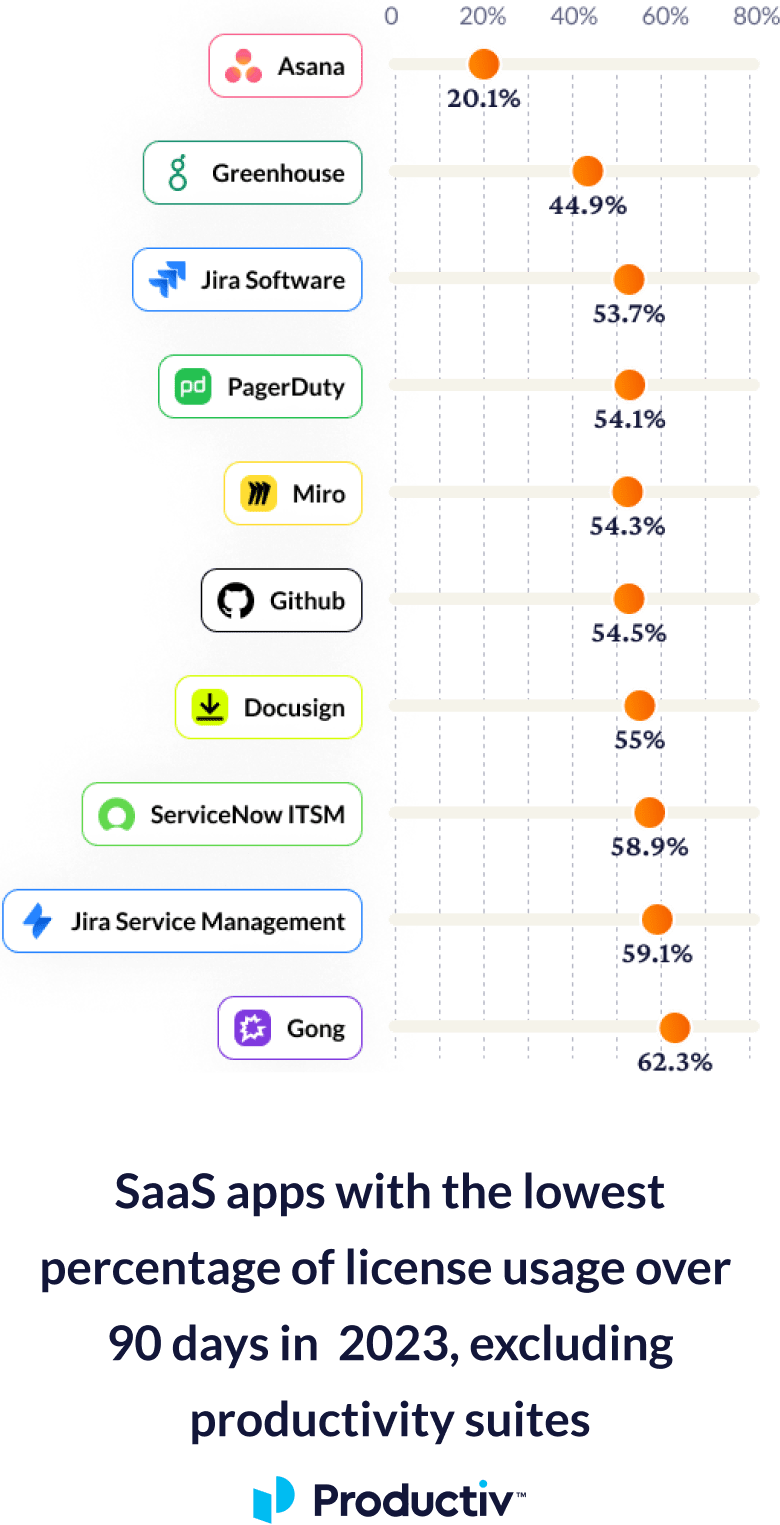

LOWEST LICENSE ADOPTION:

Duplicative apps result in low adoption rates; Collaboration apps gain traction

- Greenhouse adoption continues to fall YoY — down from 26.17% in 2022 — despite a strong performance on the overall SaaS usage chart. To see more, check out the State of SaaS — Usage installment. Its high usage but low adoption can be attributed to the app’s company-wide implementation and the nature of its use case: hiring and recruitment tend to be cyclical.

- While the apps with a low percentage of license adoption are not category-specific and offer a variety of solutions, their rate of adoption has dropped due to duplicative apps in the average portfolio.

- Important to note that many of the SaaS applications listed have features that provide value outside of license adoption. For example, examining the number of DocuSign envelopes used might be a stronger determining metric for your business.

To learn more about the report methodology,

Ready to explore more trends?

Currently Reading